What is Chapter 12 Family Farmer Bankruptcy?

TOPICS

Bankruptcy

photo credit: CafeCredit.com / CC BY SA 2.0

In recent months much attention has been given to the rise in Chapter 12 family farmer bankruptcies in portions of the U.S., e.g., Farm Bankruptcies in 2018 – The Truth is Out There. On the legislative front, the Family Farmer Relief Act of 2019 was introduced to help more family farmers reorganize and restructure their debt following several years of low commodity prices and poor economic conditions in agriculture.

Today’s article provides a high-level overview of the Chapter 12 family farmer bankruptcy provisions. Farmers seriously considering Chapter 12 bankruptcy should work with their creditors and an attorney to establish and confirm a Chapter 12 plan.

What is Chapter 12 Bankruptcy?

Chapter 12 bankruptcy was created in 1986 in response to the poor economic conditions that plagued agriculture, including low commodity prices, low farm income, record farm debt and tight agricultural credit markets. Modeled after Chapter 13 bankruptcy, Chapter 12 provides reorganizational advantages and financial relief specifically for family farmers in debt. Those advantages include a seasonal repayment schedule over a three- to five-year period and lower costs relative to other chapters. Filing under Chapter 12 provides a quick and predictable process for farmers to reorganize debt to avoid asset liquidation or foreclosure.

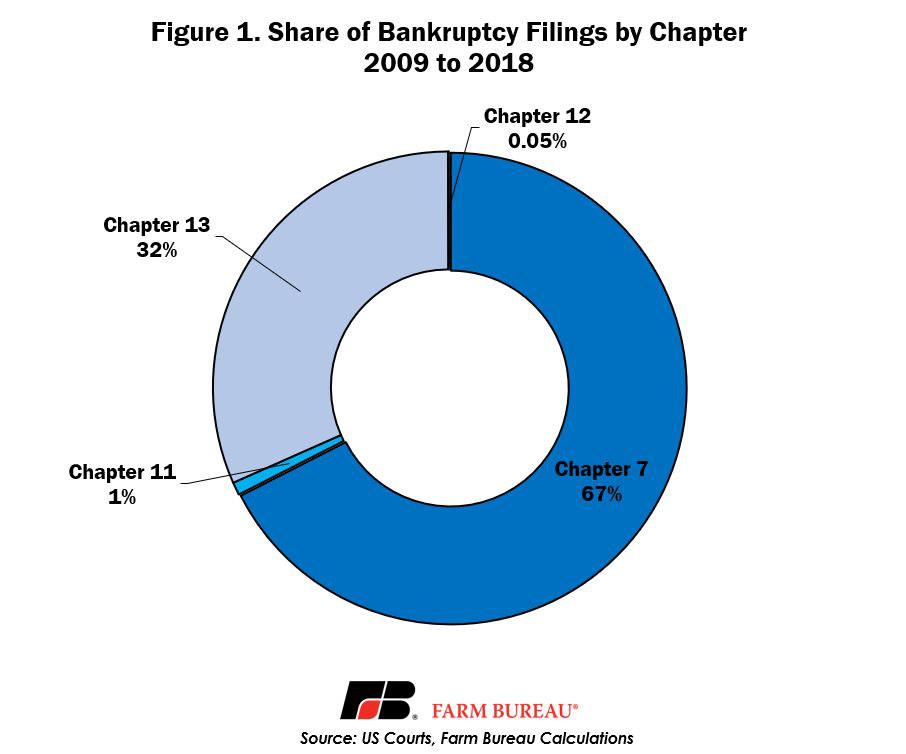

In 2018 there were 498 Chapter 12 bankruptcy filings, compared to nearly 766,000 Chapter 13 and Chapter 7 filings -- which are predominately consumer in nature. Over the last decade there have been more than 10 million total filings in Chapter 7 and Chapter 13, compared to 5,039 Chapter 12 filings. During this time, Chapter 12 bankruptcy filings have represented less than five-hundredths of a percent of total consumer and business bankruptcy filings, Figure 1.

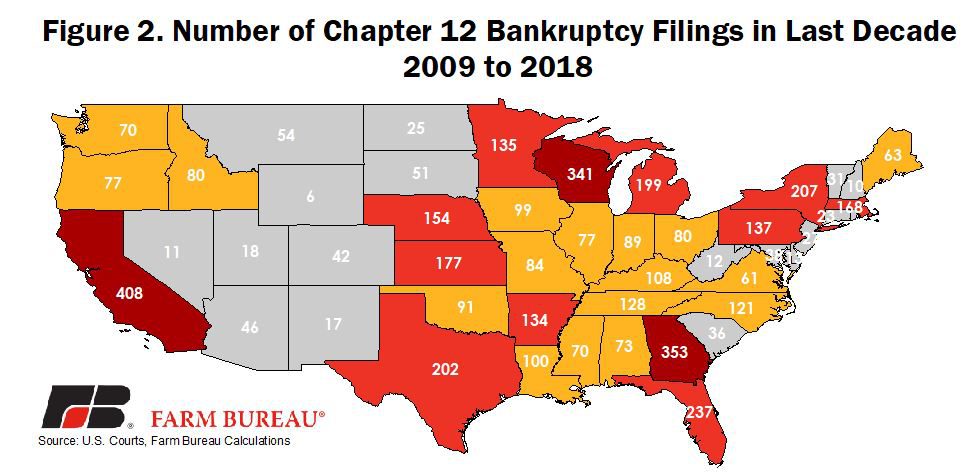

At 408, California has had the highest number of Chapter 12 filings over the last decade. Following California was Georgia at 353 filings and Wisconsin at 341 filings. Overall, Chapter 12 bankruptcies were the highest in the Midwest at 1,511 filings, followed by the Southeast at 1,484 filings. Figure 2 highlights Chapter 12 bankruptcy filings over the last decade.

Benefits of Chapter 12

There are several benefits associated with Chapter 12 bankruptcy filings.

First, debtors can cramdown debt on almost all secured debt (this is the only chapter that allows for cramdowns). A cramdown is when the debtor pays the present market value of a property rather than the whole debt during the bankruptcy filing process. For example, if a debtor owes $20,000 on a loan after the accumulation of missed payments and interest and the underlying asset for the loan is worth $15,000, the debtor can reduce – or cramdown – that debt to the base value of $15,000.

Second, the farmer can propose a repayment plan to make installments to creditors over three to five years if the plan meets the requirements set forth in chapter 12. The creditor does not need to approve the plan, nor do they have the opportunity to vote against it. Additionally, there is no requirement for equal monthly payments, allowing for seasonal or balloon payments that align with the harvesting and marketing of agricultural commodities produced on the farm.

Third, the debtor may use, sell or lease property of the estate in the normal course of business without court approval. Additionally, if a farmer sells farm assets, the tax claims from those sales can be treated as unsecured claims and they may not have to be paid in full or at all.

Finally, if the farmer is unable to complete the repayment plan due to medical illness or natural disasters, he may be eligible for a hardship discharge – effectively freeing him of remaining obligations.

Effectively, Chapter 12 provides farmers with more repayment flexibility than would be the case under Chapter 7 or Chapter 11 bankruptcy. The ability to make seasonal payments accommodates the reality of a farmer’s fluctuating income and is not offered under any other chapter of bankruptcy. In addition, the fact that farmers can sell farmland and farm equipment free and clear of liens gives them more options to pay down their debts.

Eligibility for Chapter 12

In discussions with farm lenders, Chapter 12 bankruptcy is generally considered the last resort for farmer debtors. First, lenders may seek to work with their farmer customers to find cost efficiencies, improve marketing and enhance the use of risk management tools. If Chapter 12 is used, farmers must meet the following criteria:

- The individual(s) must be engaged in a farming operation or commercial fishing operation.

- More than 50 percent of the gross income, i.e., income before taxes and other deductions, of the individual(s) for the preceding tax year must have come from the farming or commercial fishing operation. For family farmers, additional gross income criteria on prior tax years may also be evaluated relative to the gross income from farming.

- Total debts of the farm operation must not exceed $4,153,150 for a farming operation.

- For family fisherman, the total debt must not exceed $1,924,550 in inflation-adjusted dollars.

- At least 50 percent of the total debts that are fixed in amount, exclusive of debt for the debtor's home, must be related to the farming operation. For a commercial fishing operation, it’s 80 percent.

Is More Help on The Way?

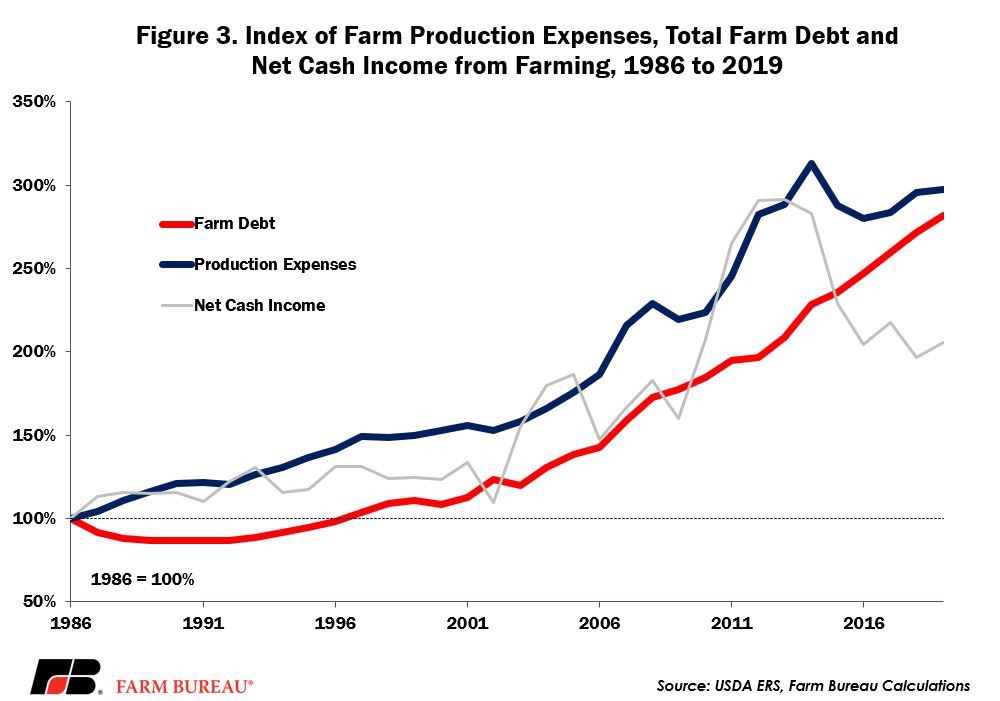

Prior to 2005, the Chapter 12 liability cap was $1.5 million, it was raised to $3.2 million in 2005, and after adjusting for inflation now stands at $4.2 million. Meanwhile, relative to 1986, and in nominal dollars, production expenses in agriculture have increased by 198 percent and farm debt has increased by 182 percent, while net cash income has experienced only half of that growth, Figure 3. As a result, the liability cap under Chapter 12 does not align with the modern credit and risk environment associated with family farming.

To more properly align Chapter 12 laws with the modern credit needs of agriculture, the liability cap should be lifted. The Family Farmer Relief Act of 2019 will do just that by raising it to $10 million in pre-inflation dollars. Recognizing that agriculture today is much different than in 1986 when Chapter 12 provisions were first introduced, the American Farm Bureau Federation supports lifting the liability cap.