August WASDE, Crop Production Reports Buoy Expectations for Large Crops

Betty Resnick

Former AFBF Economist

USDA’s Crop Production Report and August World Agricultural Supply and Demand Estimates, published on August 12, confirms that we have very large crops in American fields, with corn, soybeans and other spring wheat projected to have record and above-trend yields in 2024. The August reports are the first of the year to estimate yields for corn and soybeans based on farmer surveys and satellite imagery. Additionally, planted and harvested acreage estimates were updated to incorporate certified acreage from the Farm Service Agency.

Corn

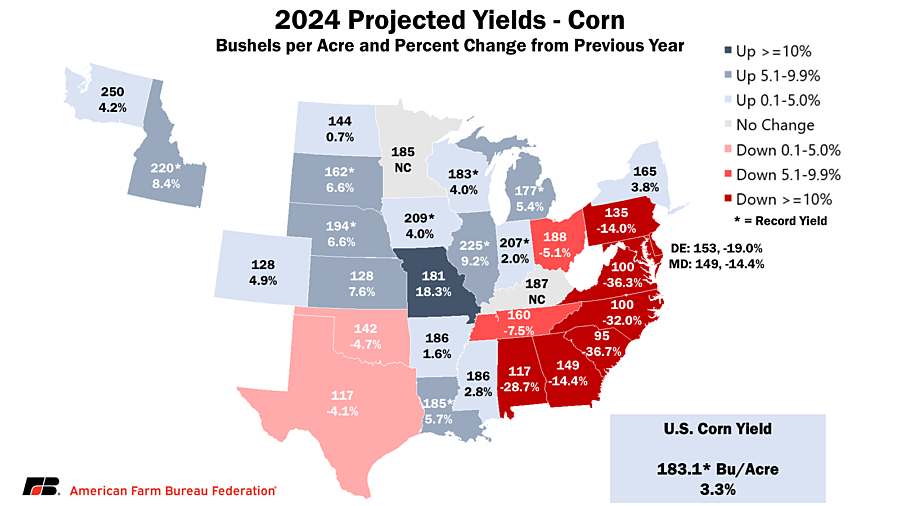

Corn yield is projected to be a record 183.1 bushels per acre nationally, up 5.8 bushels (+3.3%) from last year’s record yield and 2.1 bushels above trendline estimates. Despite this increase in yields above industry estimates, a further decrease in planted acreage to 90.7 million acres (-0.9%). pushed overall production projections downward. New crop corn production is now estimated at 15.15 billion bushels, which if realized would be the third-largest U.S. corn crop on record.

Based on this reduction in production projections and lower beginning stocks from increased old-crop exports and domestic use, the projection for total 2024 ending stocks have been reduced by 1.1% to 2.07 billion bushels. Markets responded to this neutral report positively, with December 2024 corn futures closing at $4.01, up over a nickel (+1.7%) on the day. The December 2024 corn futures contract has been hovering around the $4 mark since it first went below $4 on July 31, nearly two weeks ago. This marks a return to low prices – with corn below $4 not seen in nearly four years.

At the state level, nine states are projected to have record yields – nearly a quarter of states for which USDA projects corn production figures. All record-yield states are in the Midwest or Northwest, with Washington projected to have the highest yield in the country at a record 250 bushels per acre, a 4.2% increase from 2023. Missouri has the largest year-over-year percentage increase at 18.3%, reaching 181 bushels per acre. States throughout the Southeast are facing lower yields than last year, with the largest year-over-year decline in drought-stricken South Carolina, down 36.7% to only 95 bushels per acre. While low prices hurt all farmers, they will feel especially acute in states that are facing steep declines in yields, resulting in decreased revenue per acre on both price and production.

Soybeans

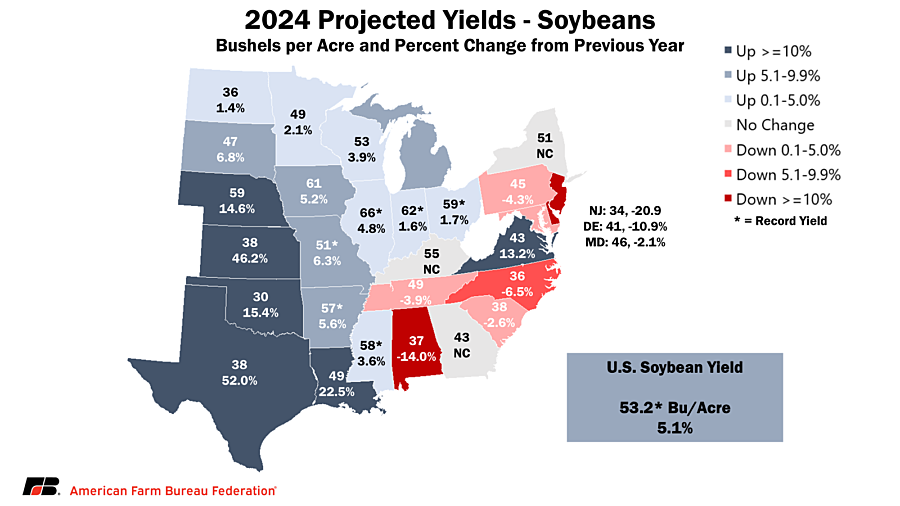

Soybean production is projected to be a record 4.59 billion bushels, a 10.2% increase over 2023 and a 3.5% increase over last month’s projections. The month-over-month projection increase is due to both an increase in yield, up to a record 53.2 bushels per acre (+2.3%), and an additional million planted acres.

Over 80% of the 154 million additional projected bushels produced were added to ending stocks on the balance sheet, pushing projected ending stocks to 560 million bushels. Ending stocks are now projected to be 62% higher than estimates for the end of the 2023 crop year. With 2024 projected production coming in well above industry expectations, markets responded decisively to this bearish report. The November soybean futures contract closed at $9.86, the first time the most-active Chicago Board of Trade contract has fallen below $10 since September 2020.

At the state level, five states are projected to have record yields including Illinois (66 bushels per acre), Indiana (62 bushels per acre), Ohio (59 bushels per acre), Mississippi (58 bushels per acre), Arkansas (57 bushels per acre) and Missouri (51 bushels per acre). Texas is projected to have the highest year-over-year percentage increase at 52%, reaching 38 bushels per acre. New Jersey is projected to have the largest year-over-year percentage decline at 20.9%, falling to 34 bushels per acre.

Cotton

Cotton production in 2024 is estimated to reach 15.11 million 480-pound bales, a decrease of 1.9 million bales (-11%) from previous estimates, primarily attributed to decreases in projected planted and harvested acres. While the 2024 cotton crop is projected to increase by over 3 million bales (25%) over the 2023 cotton crop, the August 2024 production estimate was well below industry expectations headed into the reports. Cotton yields are projected to be 840 pounds per acre, a reduction of 59 pounds (-5.6%) from 2023, in large part due to a lower projected rate of abandonment in 2024. Based on August 1st crop conditions, the abandonment rate is projected to be down to 23%, a decrease from both the 2023 (37%) and 2022 (47%) crops.

The December cotton futures contract, which has been in a fairly steady decline since April, has been on the upswing for the past few days. After the report, cotton rallied and briefly reached 70.80 cents, before falling back slightly below 70 cents by close.

Wheat

Winter wheat production is up 1.5% from July projections, reaching 1.36 billion bushels, all due to yields rising to 53.2 bushels per acre. Despite planted winter wheat acres being down 8.8% from 2023, harvested acres are up 3.7% and total production is up 9.1% year-over-year.

Both durum and other spring wheat had their yield projections lowered from the previous month, falling 10.8% and 0.9%, respectively. Yields and total production for both crops are well above 2023. Durum’s national yields are up 3% year-over-year, reaching 38.1 bushels per acre, with total production up 30%, reaching 76.9 million bushels. Other spring wheat has a similar story, with yields up 14.3% to a record 52.6 bushels per acre, and production up 7.7% to 543.8 million bushels. Both durum and other spring wheat variety estimates have surprised industry experts in back-to-back months, with production projections above industry expectations in July and below industry expectations in August.

Conclusion

Twenty twenty-four is a year of big crops, with production estimates for corn, soybeans, cotton and wheat all higher than 2023. Larger crops are weighing on already low commodity prices, with prices for corn and soybeans returning to 2020 levels.

Of course, while commodity prices have sunk back to levels unseen in four years, production costs continue to climb. In fact, USDA estimates put the per-acre cost-of-production increase between 24% - 29% for corn, soybeans, wheat and cotton between 2020 and 2024. Elevated input prices and falling commodity prices put the squeeze on farmers, many of whom will be losing money on their 2024 crops.

In tight years, it pays for farmers to think ahead. Futures can provide insights into marketing opportunities. Currently, futures are showing roughly a 30-cent gain from December 2024 to July 2025 corn contracts, and a over 55 cent carry for soybeans between November 2024 to July 2025. This means that corn and soybeans delivered in July rather than off the combine are worth 5% to 7.5% more per bushel. So, the market is paying farmers to store their crops – if they have access to storage or favorable elevator storage rates.

Top Issues

VIEW ALL