Canadian Strike Would Derail Key Ag Trade Transport

Daniel Munch

Economist

A recent decision by the Canadian Industrial Relations Board (CIRB) laid the track for a potential strike by nearly 10,000 rail workers at Canadian National Railway (CN) and Canadian Pacific Kansas City Railway (CPKC). The looming strike, approved by the CIRB to start on Aug. 22, would severely disrupt U.S.-Canada agricultural trade, leading to commodity and input delivery delays, shortages, commodity price volatility and other rippling impacts on the integrated North American agricultural supply chain.

The potential strike, approved on May 1 by members of the Teamsters Canada Rail Conference, was initially delayed while the CIRB assessed whether it would threaten public health and safety. On Aug. 9, the CIRB ruled that the strike would not pose an immediate danger, citing “reasonable alternatives” like long-haul trucking.

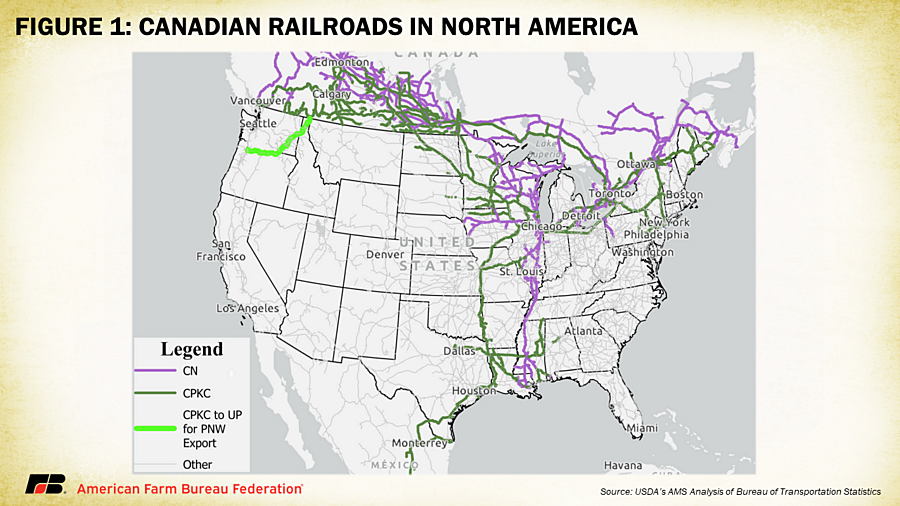

CN and CPKC own 50% and 30% of the 26,800 track miles in Canada, respectively, with the remainder managed by about 40 short-line railroads that provide first-mile/last-mile service to customers not served directly by Class 1 railways. U.S. class 1 railroads including Burlington Northern Santa Fe (BNSF), Union Pacific, Norfolk Southern and CSX, which all interchange with CN and CPKC at crossings along the border. Both CN and CPKC also operate track in the U.S., while BNSF and CSX have tracks extending into Canada. A potential strike would disrupt rail movements only within Canada on CN and CPKC lines; operations in the U.S. could continue unaffected.

A recent USDA-Agricultural Marketing Service Grain Transportation Report summarized U.S.- Canadian agricultural trade, emphasizing agricultural products moved by rail. The report noted that in 2023, $28.2 billion of U.S. agricultural products were exported to Canada, making Canada the third-largest destination for agricultural exports (behind China and Mexico). In the same year, the United States imported $40.1 billion of Canadian agricultural products, making Canada the second-largest origin of U.S. agricultural imports (behind Mexico).

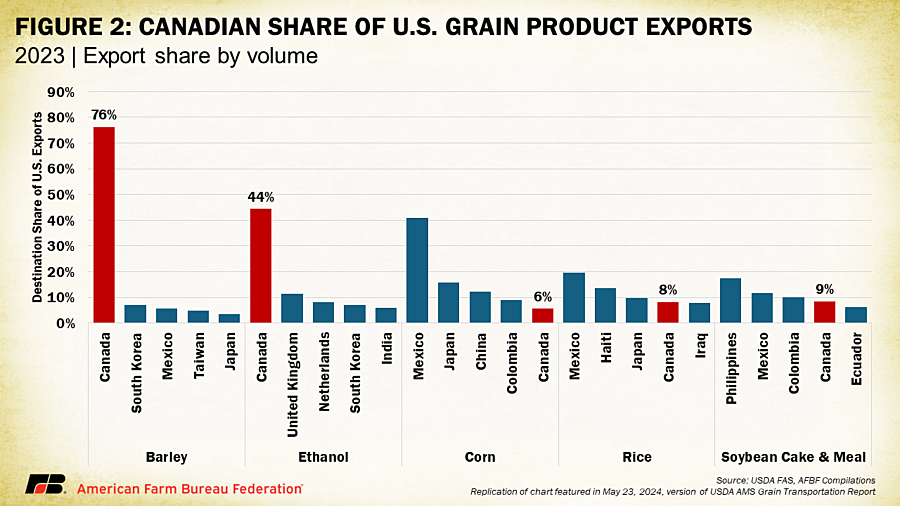

In 2023, Canada was the leading destination for several key U.S. agricultural exports, including ethanol and barley, with 76% of U.S. barley exports and 44% of ethanol exports heading north of the U.S. border. Canada also ranked as the fourth-largest market for U.S. soybean meal and rice, and the fifth largest for corn (Figure 2). Interestingly, a portion of these exports is transported to Canada, then moved westward across the country before being re-exported through Pacific Northwest ports on both sides of the border. This complex logistical flow means that a Canadian rail strike could disrupt not only trade with Canada but also with key markets in Asia and Oceania, further amplifying the potential risks and impacts on U.S. agricultural exports.

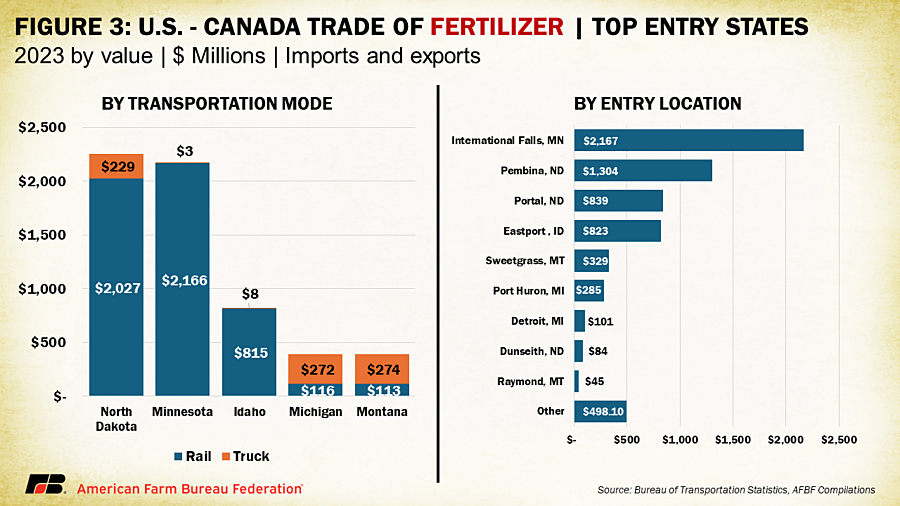

In addition to being a major destination for many U.S. agricultural products, Canada is a key source of fertilizer for U.S. farmers. Though the U.S. is the third-largest producer of fertilizer globally, it still relies on imports to fully meet domestic demand. For example, Canada holds potash deposits not found in the U.S. that are vital to produce potassium-based fertilizers. USDA noted that in 2023, from all sources, the U.S. imported 13 million tons of potash, with 85% originating in Canada. Canada is also a primary source of nitrogen-based fertilizer imports. USDA reported, on a nitrogen-equivalent basis, just over 25% of all U.S. nitrogen imports came from Canada in 2023. This corresponded to 3.1 million tons of nitrogen-based fertilizers, including 1.2 million tons of anhydrous ammonia, 510,000 tons of urea and 420,000 tons of urea ammonium nitrate. For perspective, between 2005 and 2020 the U.S. imported between 30% and 59% of its ammonia-based fertilizer use.

More than 85% of fertilizer trade between the U.S. and Canada is transported by rail, with the remainder handled by trucking (12%) and waterborne vessels (3%). The vast majority of this trade — over 90% — occurs at border crossings in five states: North Dakota (90% by rail), Minnesota (100% by rail), Idaho (99% by rail), Michigan (29% by rail) and Montana (29% by rail). In 2023, Over $2.1 billion in fertilizer trade occurred across the border crossing in International Falls, Minnesota; $1.3 billion occurred across the border crossing in Pembina, North Dakota; and $839 million occurred across the border crossing in Portal, North Dakota (Figure 3).

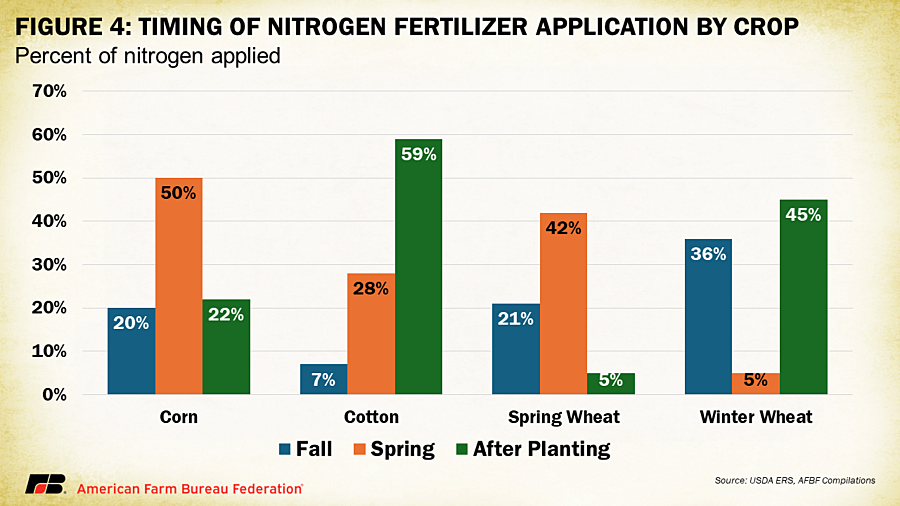

Disruptions to railway access between the U.S. and Canada could severely jeopardize farmers' ability to secure essential inputs critical for crop growth. This is particularly concerning with nitrogen fertilizer, a key input for many crops, with a significant portion applied in the fall. Specifically, 36% of nitrogen for winter wheat, 21% for spring wheat, 20% for corn, and 7% for cotton is typically applied during this season. Given that a significant portion of nitrogen fertilizer is sourced from Canada, this situation creates a perfect storm of conditions, where the reliance on Canadian supply chains and the critical timing of fall applications could converge to significantly impact future crop yields and farm operational schedules.

Current crop storage and yield conditions in the U.S. heartland could further intensify the impact of a potential Canadian rail strike on U.S. agricultural markets. USDA’s Crop Production Report and August World Agricultural Supply and Demand Estimates, published on August 12, confirms that we have very large crops in American fields, with corn, soybeans and spring wheat projected to have record and above-trend yields in 2024. Alongside this anticipated bumper crop, many farmers, faced with low and declining commodity prices, have opted to store their previous harvests, hoping for more favorable market conditions. Add a Canadian rail strike to the mix, and many farmers will find themselves in a pressure cooker of sorts with limited options to move product.

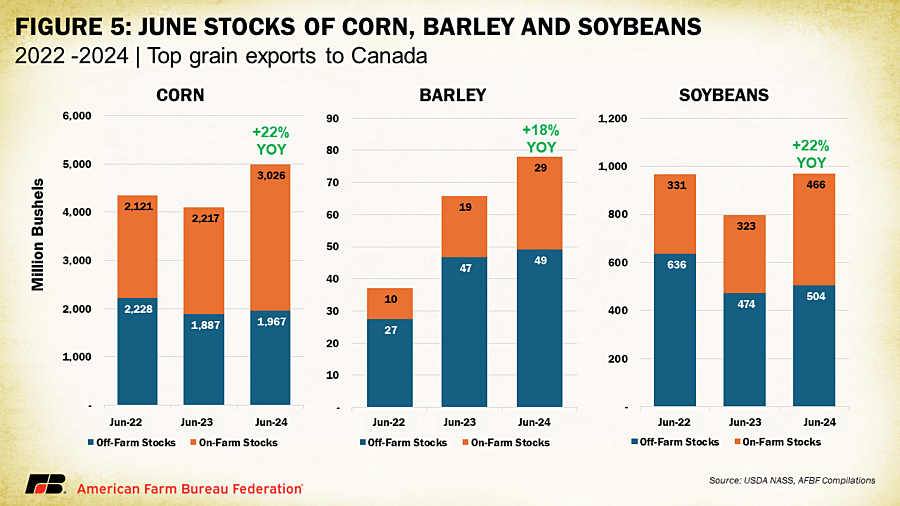

June 2024 estimates of corn stocks are up 22%, barley stocks are up 18% and stocks of soybeans are up 22% over the same period last year across on- and off-farm storage. Canada, a major export market for these crops (as shown in Figure 2), relies heavily on rail transport for trade, with 50% of grain trade between the U.S. and Canada occurring via railways in 2023. This trifecta of high incoming supply, substantial existing stocks and potential market blockages due to the strike could place even greater economic strain on U.S. farmers. A shutdown of operations above the northern border can also boost transportation costs for farmers as the supply chain attempts to calibrate for lost capacity and may shift to costlier transportation options like trucking. Farmers are all too familiar with the consequences of such disruptions, having recently endured an era of elevated railway costs and unfilled grain car orders that hampered their ability to move products efficiently.

Conclusion

The U.S. and Canadian agricultural economies are deeply intertwined. They are integrated and complementary, from Canadian phosphate mines to U.S. corn fields to a common North American cattle industry, American agriculture – including our international competitiveness – benefits from the efficiencies of smooth cross-border trade.

A Canadian rail strike poses a significant threat to U.S. farmers, who are already expecting record crop yields and grappling with substantial stored supplies. With Canada serving as a major export market and a critical source of fertilizers, any disruption in rail transport could create a cascade of negative market impacts. The strike would not only hinder the movement of essential agricultural products but also exacerbate existing market pressures, particularly in the Midwest. As farmers contend with low commodity prices and limited storage capacity, the potential for delayed shipments and supply chain bottlenecks could severely undermine their profitability and restrict valuable access to foreign markets, placing additional pressure on an already vulnerable agricultural sector.

Looking ahead: A potential strike of 85,000 longshoreman across U.S. East and Gulf Coast ports starting Oct 1 would present similar challenges and cap vital exports terminals necessary for the U.S. agricultural economy to thrive.

Special acknowledgment is extended to Jesse Gastelle, Austin Hunt, and Peter Caffarelli of the USDA's Agricultural Marketing Service for providing invaluable insights and data in the May 23, 2024, release of the Grain Transportation Report, which served as a crucial basis for this work.

Top Issues

VIEW ALL