Crop Planting Delays Reach Historic Levels Resulting in High Levels of Uncertainty for 2019

TOPICS

USDAMichael Nepveux

Economist

photo credit: Alabama Farmers Federation, Used with Permission

Michael Nepveux

Economist

In many parts of the country, the weather just isn’t cooperating for farmers. All across the farm belt record-breaking precipitation has been causing headaches for farmers with flooding of fields and excess soil moisture. As a result, tractors are getting stuck in mud, fields are completely underwater, and Mother Nature is doing her very best to keep crops from getting put into the ground. On Tuesday, USDA released the latest Crop Progress report showing historic delays in corn and soybean plantings across farm country. Many acres are, or soon will be, eligible for prevented planting payments through corn crop insurance policies. We are looking at the biggest event for grain and oilseed markets since the drought of 2012. The combination of record-breaking extreme weather alongside continued policy uncertainty has agricultural economists across the board scratching their heads trying to figure out how everything will shake out. At this point, the only thing for certain is that nothing is known with any degree of certainty.

Delays in Planting

USDA’s Tuesday release of the Crop Progress report showed historic delays in corn and soybean plantings across the country. Looking at the five year average, typically at this point in the year corn planting would be 90% complete, but this year farmers have only planted 58% of their intended acres. This translates to nearly 39 million acres of corn still waiting to be planted, which is an astronomical number, especially at this point in the year. We talk about corn experiencing historic delays in planting, but to put that in perspective it is helpful to look at some of the worst years in planting delays. Figure 1 shows 2019 planting progress for corn alongside the five-year average and 1993 and 1995, two years that are widely cited as being some of the most delayed in corn planting.

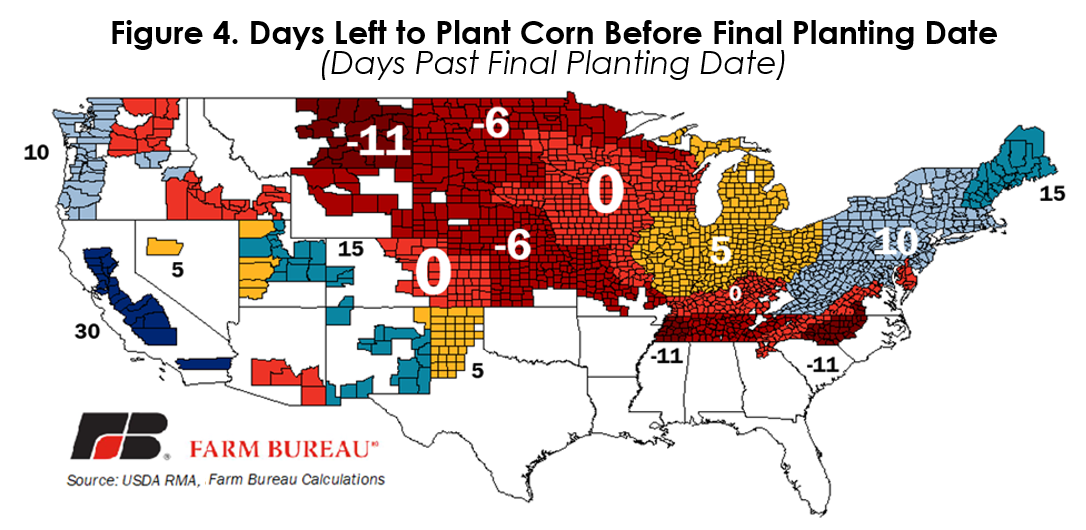

2019 started out relatively in line with 1993 and 1995, even performing better through week 18. However, in the past three weeks, this year’s progress has fallen further and further behind, with the most recent week at 13 percentage points behind the next worst year for corn planting. Some states are certainly hit worse than others, with South Dakota, Illinois, Indiana and Ohio being hit particularly hard of planting delays.

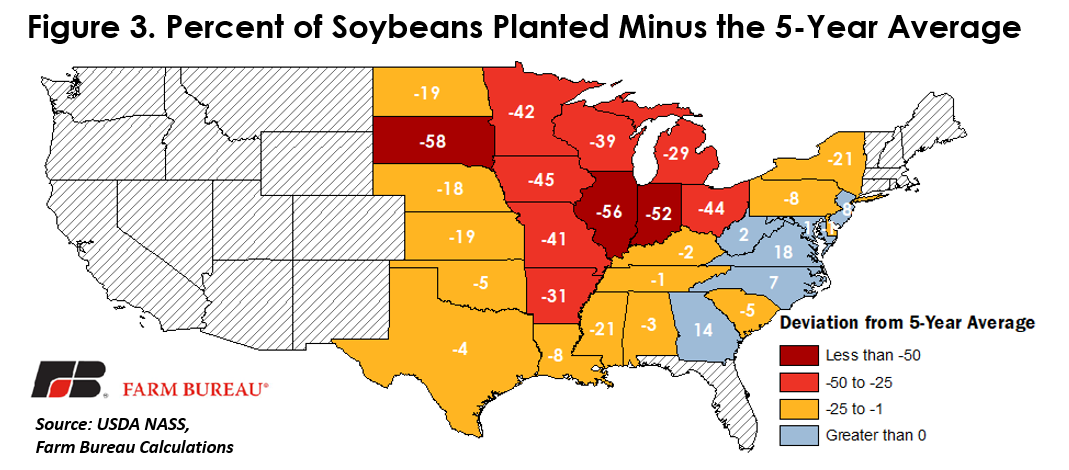

Soybeans are planted later than corn, but so far are showing a similar pattern, largely falling behind the five-year average. The U.S. is only 29% complete on planting soybeans, while the five-year average is 66%. As of this week, there are still 60 million acres of soybeans that farmers intended to plant that are not planted.

Some in the industry have argued that farmers are doing the math between prevented planting and current corn prices to see which option is more economical. They are looking at historical years of Crop Progress reports and extrapolating those results on this year’s progress. But that may not apply here, as it might come down to whether or not farmers can even physically get out there and plant the crop. We are sitting on record floods, and many states in the corn belt are looking at record levels of topsoil measured at a surplus moisture level. There would need to be several days of sun and no rain in order to get the fields close to where they need to be for those looking to plant in the next week to be able to do anything, but the current forecast does not seem to be cooperating.

Uncertainty, Uncertainty, Uncertainty

Right now, weather is the primary driver of uncertainty in planting progress over the next few weeks. However, the political realm is doing its best to compete and add another layer of uncertainty around farmers’ planting decisions. If Mother Nature cooperates, some farmers still have time to plant corn before they begin to lose a share of the crop insurance coverage.

If this weather were occurring in a normal year many farmers would take the prevented planting payments on their crop insurance policies as for many farms, corn prices have not increased enough to push net returns from planting above net returns from prevented planting payments. What makes this year so challenging to predict is uncertainty surrounding two policy provisions (assuming of course Mother Nature even gives farmers a chance to plant).

In its original announcement of another round in the Market Facilitation Program, USDA said that payments would occur with a single county rate on crops that are planted in 2019. USDA did not say what the payment rates would be and emphasized that the program would not influence planting decisions. Despite their best efforts, the announcements of direct payments tied to planting decisions are very likely impacting growers’ decisions. While USDA has not announced the rates, many farmers who may have otherwise taken the prevented planting option may look to plant something in order to participate in the MFP program as the original announcement stated that payments would only be paid on planted acres.

This decision is further complicated by ad hoc disaster assistance legislation currently working its way through Congress. This bill ostensibly enhances the prevented planting payment factor on crop insurance. However, there is uncertainty about whether this would be applicable to many counties in the Midwest which is where the majority of these planting decisions are being made, or in federal disaster areas only. Regardless, passage of this bill has been blocked three times this week, and will not likely be considered again until a later date.

Adding additional uncertainty to the planting decision, yesterday Agriculture Secretary Perdue hinted that there is still a possibility that farmers who file prevented planting insurance claims may still be eligible for payments under the new MFP program. The justification is that acres prevented from being planted have a lower insurance value due to the adverse impact of retaliatory tariffs on spring crop insurance prices (Tariffs Impact Crop Insurance Coverage in 2019).

Potential Implications of Corn Prevented Plantings

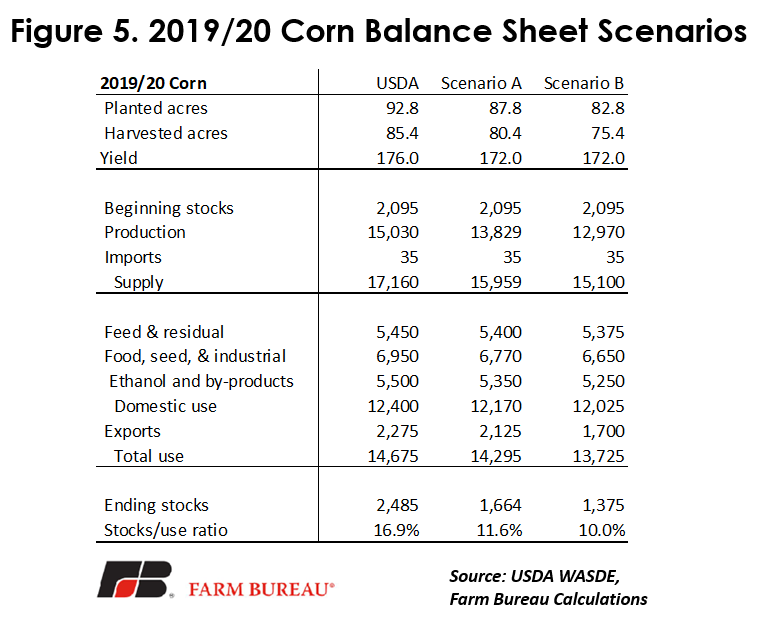

Now that we have all the uncertainty we can handle, we get to move on to the fun job of trying to figure out a few scenarios of how this all may translate to the balance sheet for 2019. In our first scenario (scenario A), we take a somewhat conservative estimate (especially considering some of the numbers being talked about in the trade) of a decline of 5 million acres of corn, and a yield decline of 4 bushels per acre from USDA’s last WASDE. Scenario B takes a similar yield decline, but a bigger hit to acres with a 10 million decline. Scenario A results in total production of 13.83 billion bushels, and with my assumptions on consumption changes draws down our carryout to 1.66 billion bushels, or 11.6% stocks-to-use ratio. Scenario B results in a total production of 12.97 billion bushels, and with my assumptions on demand rationing our carryout drops to 1.38 billion bushels, or 10% stocks-to-use ratio.

In either circumstance, a lower stock-to-use ratio is sure likely to lift new-crop corn prices above the current projection of $3.30 per bushel. USDA’s June 28 Acreage report will provide the first survey-based estimate of crops that were actually planted in 2019.