Dairy Margin Coverage Enrollment Remains Delayed

photo credit: Right Eye Digital, Used with Permission

Daniel Munch

Economist

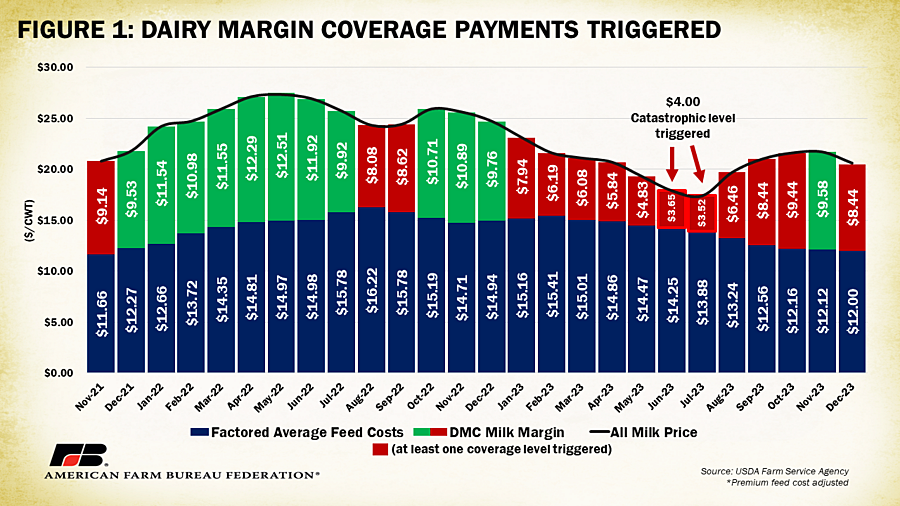

In June and July 2023, the Dairy Margin Coverage (DMC) program’s catastrophic coverage margin level of $4 per hundredweight was breached for the first two times since the program’s 2019 beginnings. For every month in 2023, excluding November, persistent above-average feed costs and a depressed all milk price resulted in margins below $9.50, the upper hundredweight program margin. Despite the extension of 2018 farm bill programs through September of this year, dairy farmers are still waiting for DMC enrollment for 2024 to open. In this Market Intel we review the latest on the DMC enrollment delay and review cost conditions creating cash flow concerns for farmers.

The DMC program provides a level of risk protection to dairy producers under low margin conditions, whether caused by low milk prices, high feed costs, or both. This voluntary program provides payments when the calculated national margin falls below a producer’s selected coverage trigger. The margin is the difference between the average price of feedstuffs (the price of a ration of hay, corn and soybean meal) and the national all milk price. Coverage is available for margins between $4 and $9.50 under a Tier I CAT (catastrophic) level or between $4 and $8 for Tier II, in 50-cent increments. Tier-one coverage is capped at 5 million pounds of production.

As noted earlier, in 2023 we saw the lowest DMC margins on record when June and July surpassed the program’s “catastrophic” $4 margin for the first and second time since the program began in 2019. Catastrophic coverage is a premium-free program option, meaning there is almost no risk to the producer enrolling besides a $100 administrative fee, and signals dire margin situations. All 17,085 dairy farm operations enrolled in 2023 DMC (about 80% of all U.S. dairy operations) receive payments for months when the catastrophic margin is triggered. Margins steadily improved between August and November atop a modest but much-welcomed decline in feed costs and slightly improved all milk price. The August $6.46 per hundredweight margin grew to $8.44 per hundredweight in September, $9.44 per hundredweight in October and $9.58 per hundredweight in November. December’s calculations, however, bucked this upward margin trend, dropping back below $9.50 per hundredweight to $8.44 per hundredweight, resulting in payments for producers holding policies with protection at the $8.50 level or higher.

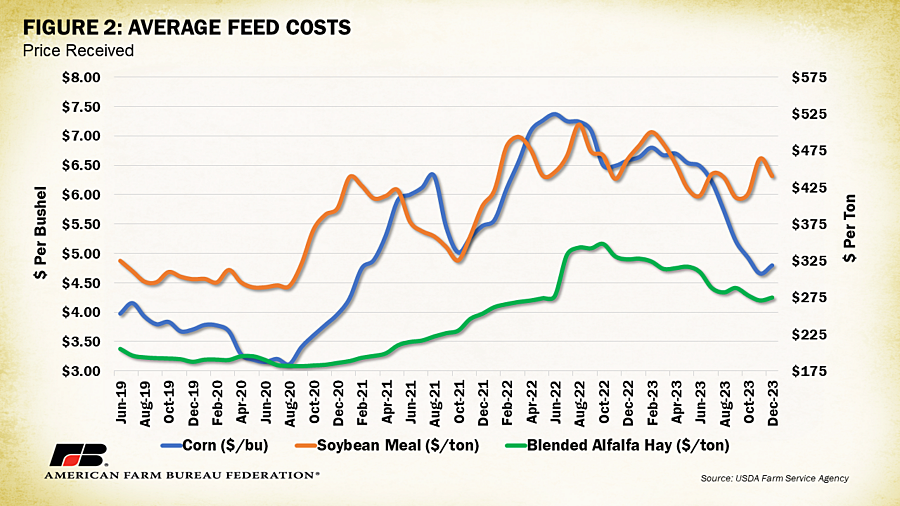

As feed costs are the only input cost accounted for in the DMC calculation, whether or not dairy farmers will see returns on their enrollment depends wholly on the relationship between the cost of corn, soybean meal, premium alfalfa and the all milk price. In December 2021, the calculation of alfalfa within the factored average feed costs was increased from 50% to 100% premium alfalfa hay. In making the adjustment, the Farm Service Agency (FSA), which administers the DMC program, meant to make future payments more reflective of true dairy expenses. This update has remained in place through 2023.

As of December 2023, all three feed categories are lower in cost than they were in December 2022. Corn prices are down $1.78 a bushel (-27%), soybean meal prices are down $22 a ton (-4%) and blended premium alfalfa hay prices are down $52 a ton (-16%) over December 2022. That said, December 2023 soybean meal and hay prices remain above the 2020-2022 three-year average with hay up $40 a ton (14%) over the three-year average and soybean meal up $50 a ton (11%). Combining the feed prices with a December all milk price of $20.60 per hundredweight, which is $6.20 lower than December 2022 and 25 cents lower than the 2020-2022 average, reveals the squeeze dairy farmers face entering 2024. Notably, there are many other operating costs such as fuel, electricity, veterinary care, labor, bedding and litter, interest and taxes that are not accounted for in the DMC margin calculation but are up to 50% of total costs to produce milk. For this reason, any possible interpretation of a DMC margin as profit is far from the truth.

As of Feb. 1, DMC enrollment for calendar year 2024 remains unopened. The expiration of the 2018 farm bill in September 2023 created uncertainty for the program, but passage of the Further Continuing Appropriations and Other Extensions Act of 2024 keeps 2018 farm bill programs and provisions in effect through the end of the fiscal year. Several commodity programs including Agriculture Risk Coverage and Price Loss Coverage opened enrollment by December 18th. For comparison, 2023 DMC enrollment opened on Oct. 17, 2022.

FSA reports two main factors for the delay. The first is a requirement to publish a new rule in the Federal Register extending Supplemental Dairy Margin Coverage (SMDC) for 2024. SMDC was first authorized under the Consolidated Appropriations Act of 2020, and allows dairy farmers to adjust production history elections based on 75% of the difference between 2019 marketings and the old base calculation (2011-2013 milk marketings). This change allows operations to opt for higher milk production coverage if changes to herd size were made since the 2011-2013 basis years (within the 5-million-pound limitation). The issue being when originally signed into law, SDMC would apply to 2021 (retroactively), 2022 and 2023 calendar years with no coverage stipulated for further years. Farm bill extension language extends SDMC for 2024 but the regulatory process requires a new agency rule be published before enrollment can open. The second factor is software and database updates needed to make milk production history modifications for 2024 program implementation. FSA has made assurances that delays in enrollment will not impact full-year enrollment and farmers will receive retroactive protection for all months DMC is delayed.

Each month DMC is delayed gives dairy farmers more time to track market information including feed costs and milk prices before they must make their enrollment decision. However, farmers’ biggest concern is the delay in payment when it is needed most, that is, when margins are tightest and cash flow is most strained.

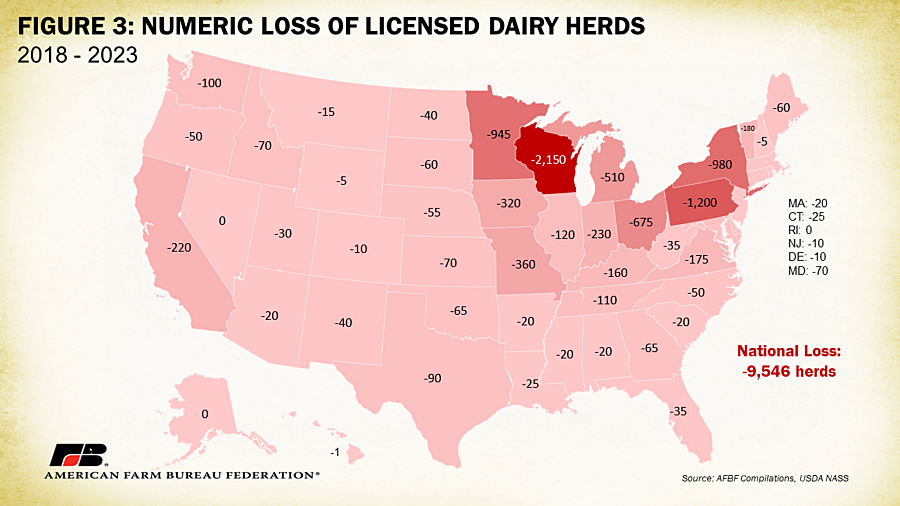

Uncertain cost, price and policy conditions continue to make it harder for dairy farmers to turn a workable profit. In many instances, the barriers have proven insurmountable, leading to dairy farm closures across the country. USDA’s February milk production reports show that over the last six years, the United States lost 9,546 licensed dairy herds. States in the upper Midwest and Northeast have been the hardest hit in number of herds lost, with losses of over 2,000 herds in Wisconsin, 1,200 herds in Pennsylvania, 980 herds in New York and 945 herds in Minnesota, to name a few examples (Figure 3).

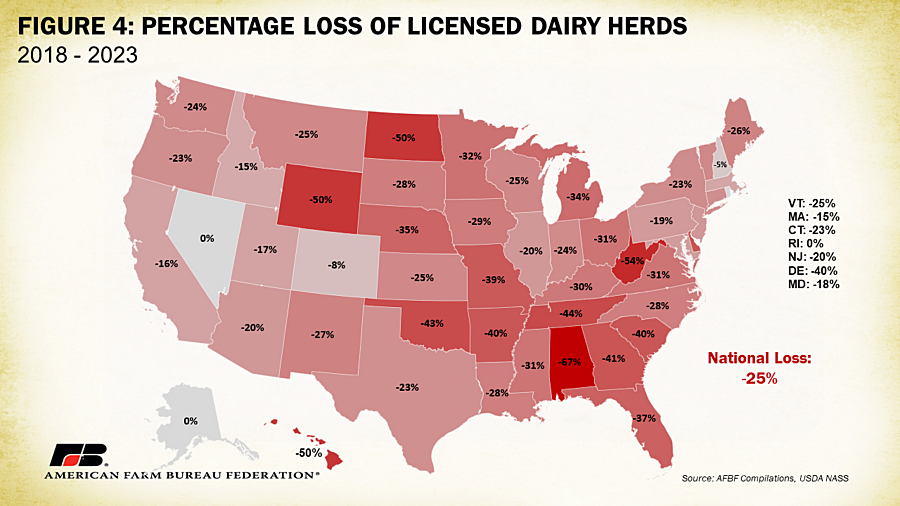

Figure 4 displays the percentage loss of dairy herds, with a quarter of herds lost nationally between 2018 and 2023. Alabama, Hawaii, North Dakota, Wyoming and West Virginia have all experienced herd declines of 50% or more. Generally, many of the cows from closed dairy farms end up at other farms, raising the average herd size of remaining farms, with some regional variation. High-cost environments push dairy farmers to be more and more reliant on economies of scale or cost savings associated with increases in output. Programs such as DMC help buffer against these conditions and counter the loss of operations vital to so many rural communities.

Conclusion

Risk management programs like DMC provide a revenue buffer for producers being tightly squeezed by shrunken operational margins. Government process hurdles that have delayed DMC enrollment threaten cash flow for dairy farmers who utilize DMC to help protect against month-to-month price volatility. Though knowledge of guaranteed, retroactive coverage is comforting, timely administration of farm bill programs is vital to ensuring a stable farm economy that provides food security to millions of consumers domestically and abroad.

Top Issues

VIEW ALL