Fall 2022 Survey Reveals Marginal Drought Improvements for Farmers and Ranchers

photo credit: Montana Farm Bureau, Used with Permission

Daniel Munch

Economist

With over 60% of the American West, Southwest and Central Plains categorized as D1 (moderate) drought or higher, AFBF conducted a fourth round of its survey to evaluate drought’s continued impact on farm and ranch businesses. A summary of the June 2021 survey results can be found here , October 2021 results here and July 2022 results here.

The 17 states including and north of Texas, up along the central Plains to North Dakota and west to California are vital to the U.S. agricultural sector, supporting nearly half of the nation’s $364 billion production by value. This includes 74% of beef cattle, responsible (in total) for 18% of U.S. agricultural production by value; 50% of dairy production, responsible (in total) for 11% of U.S. agricultural production by value, over 80% of wheat production by value and over 70% of vegetable, fruit and tree nut production by value. Drought conditions, which continue in many areas, put production of these commodities at risk, along with the stability of farms, ranches and local economies reliant on crops, livestock and downstream products and services for income.

Assessing Western Drought Conditions Survey

To further quantify some ground-level drought impacts, AFBF distributed a fourth drought conditions survey between Oct. 19 and Dec. 13 to state and county Farm Bureau leaders, staff, and farmer and rancher members in the affected states. The survey includes several demographic questions to distinguish state affiliation followed by three separate sections: Crop-Specific Factors, Livestock-Specific Factors and General Water Access. Each section consists of a set of issues farmers and ranchers may be facing because of persistent drought conditions (i.e., selling off portions of the flock/herd or reduction in expected harvest yields). On a scale of 0 (not at all prevalent) to 5 (extremely prevalent), respondents were asked to select how prevalent each issue was in their area based on their own experience or outreach with members. Each section also includes a dedicated area for further commentary. Importantly, the geographic footprint of extreme drought has shifted between 2021 and 2022, with states in the Pacific Northwest like Washington and Idaho having relatively better conditions, while states like Texas, Kansas and Arkansas have faced widespread drought in the highest, D4 - exceptional, drought category. It is worth noting, data collection took place before the many recent precipitation events.

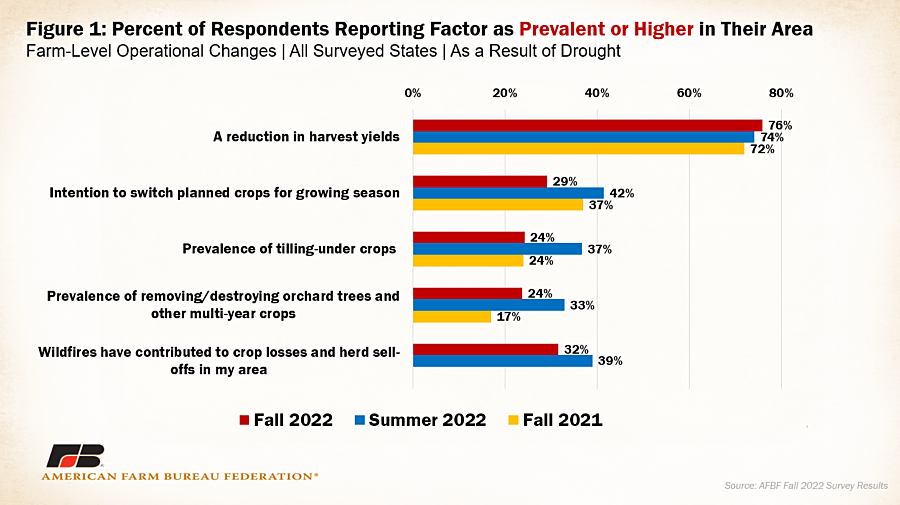

The survey closed with over 550 responses from 16 states in the drought-stricken region. Figure 1 summarizes weighted percentages of respondents across all states reporting a certain drought-related operational factor as prevalent or higher in their area; this includes participants who selected prevalent, very prevalent or extremely prevalent for the crop factors section of the survey. The red bar denotes results from the fall 2022 survey, the blue bar denotes results from the summer 2022 survey and the yellow bar denotes fall 2021 results.

Crop Yields

Seventy-six percent of respondents rated a reduction in harvest yields due to drought as prevalent or higher in their area, slightly higher than both summer 2022 results (74%) and fall 2021 results (72%). Twenty-nine percent of respondents rated the intention to switch planned crops for the growing season due to drought as prevalent or higher, down from 42% this past summer and 37% in fall 2021. Notably, those who reported tilling under crops because of drought conditions dropped back to fall 2021 levels (24%) after jumping to 37% of respondents in the summer 2022 survey. Similarly, the 24% of respondents who reported removing orchard trees and other multiyear crops as prevalent or higher is down from 33% in the summer 2022 survey, though the number of respondents remains elevated from fall 2021 (17%). A Sutter County, California, farmer commented, “Many orchards are being removed. There are also substantially fewer rice acres farmed in our area due to lack of water.” One likely reason the percentage of farmers tilling-under or removing crops due to drought has dropped is simply from already doing so earlier in the year, which is reflected in the higher summer 2022 number. For the few who choose to replant, it will be many months, or years, before an average revenue stream is present. One Sonoma County, California, farmer commented, “Some farmers are replanting vineyards, so overall production is down and yields are also reduced for vineyards that remain.” Other reasons include marginally improving moisture conditions in parts of the West. In parts of Montana and Idaho, for example, farmers reported good moisture and adequate rains, a stark contrast to the conditions there a year ago.

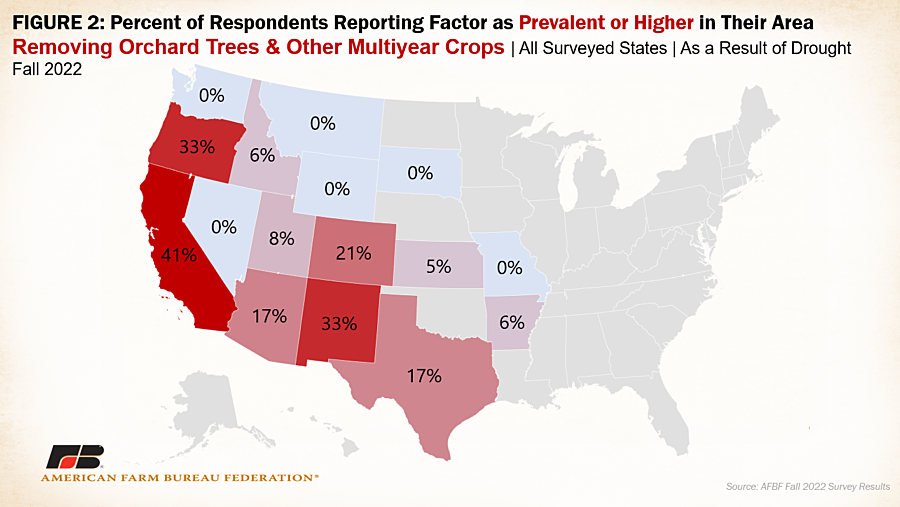

As expected, prevalence of orchard and multiyear crop removal remains most common in states with high fruit and tree nut crop production such as California and Oregon, where 41% and 33% of respondents, respectively, reported that factor as prevalent or higher.

Across the surveyed region, respondents expected average crop yields to be down 44% in 2022 because of drought conditions (up from 38% from the summer 2022 results), with the biggest drop expected in Texas (yields reported down 66%), followed by Kansas (down 63%) and Nevada (down 60%). Washington farmers are expecting the lowest yield decline in the surveyed region (down 6%). Abysmal production conditions are testing farmers’ abilities to operate. One Pinal County, Arizona, farmer commented:

“Unable to plant cotton, didn’t have enough water for barley, should have eight-10 cuttings of alfalfa by now but only have one.”

And a Kendall County, Texas, farmer noted:

“We planted milo, a more drought tolerant crop. It did not grow past about 1 foot tall and then died. November and this first part of December has seen some rain and drizzle.”

Diminished crop yields have implications beyond plant crops. Apiaries and the honeybees that occupy them rely on the nectar and pollen from flowering plants to produce honey. With reduced water and reduced plant production comes reduced pollination activity and a smaller honey crop. Apiarists then become forced to feed hives through other means or face losing their bees. A Shasta County, California, farmer wrote, “Our land no longer has water, so our bees have lost their grazing land. We haul water to all of our locations. Have not made a honey crop, instead we are feeding with costs up to $100,000 and more this year alone.”

Regional disparities in precipitation continue to impact farmers in vastly different ways. Acreage experiencing continued dryness has reduced soil health and the long-term productivity concerns that come with it. One Cheyenne County, Colorado, farmer reported, “We are experiencing continued soil moisture depletion, no perceptible recharge. Soil surface becoming powdery and more fields experiencing blowing soil during high winds.”

In stark contrast, parts of California have recently been inundated with rain which occured after survey data collection. After many years of exceptional drought, soil is commonly too dry to allow moisture to seep in often resulting in excessive runoff instead of absorption and in extreme cases, mudslides. In Salinas Valley, where more than half the nation’s lettuce and leafy greens are produced, rains have delayed land preparation and planting procedures. For farmers who haven’t yet planted, flood waters invite time-intensive food safety testing protocols to ensure fields are safe to grow produce for human consumption. Testing for potential pathogens can take up to 60 days depending on results and how soon waters recede from fields, delaying production. Planting delays in regions that feed global markets bring uncertainty to consumers already facing volatile food prices and farmers trying to recover from years of disaster-related crop losses.

Livestock Production

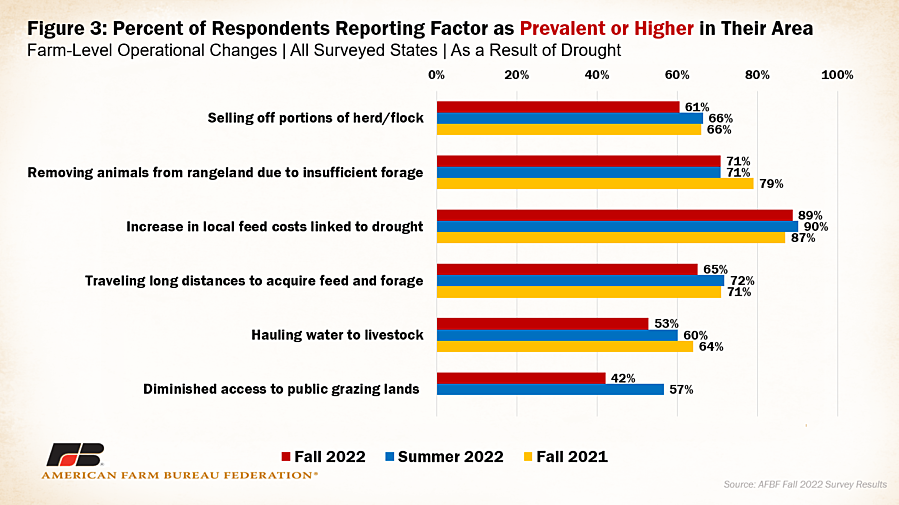

Figure 3 summarizes results from the livestock factor section of the survey. Eighty-nine percent of respondents reported an increase in local feed costs as prevalent or higher in their area, down one point from summer 2022 results. As the region provides over 70% of the nation’s hay, widespread low-quality or insufficient forage means farmers and ranchers must look elsewhere for a smaller supply of feed at exorbitant prices, and often located a long distance from the farm or ranch.

Slightly less than two-thirds of respondents reported prevalence of selling off portions of their herd or flock, with average herd sizes expected to be down 33% in the surveyed region (slightly less than 36% expected in summer 2022). The largest herd decline remains in Texas (herds reported down 46%), followed by Nevada (down 45%) and Arkansas (down 35%). Idaho expected to have the smallest average herd size decline (down 12%). Insufficient and poor-quality forage forces liquidations, which cut into operational income. One Perry County, Arkansas, farmer reported, “We have had several ponds completely dry up, and there is nowhere for the cattle to be moved, so we have to sell. Digging a well is just too expensive, especially with rising fuel prices. We bought some hay from out of state, but it is too expensive to buy and still pay our bills.” Scarce and lower quality forage also impacts feed conversion ratios necessary to reach desired market weights. Many respondents reported lower weights of animals sold, reducing the benefits of higher per-pound beef prices due to smaller volumes. In Duchesne County, Utah, a rancher described:

“If many of our mother cows are not pregnant and are older than 5 years old, they will be sold. If they are younger than 5 years old, we will make a decision based on the quality of the cow as to whether they will be culled or not. Currently, our pasture conditions are poor, but we have sufficient hay to feed from Dec. 1 through May 1, provided snow cover allows grazing. With the forecast of at least six more months of La Nina, and the result being another light/ or dry winter, further cuts may be necessary. Our calf weights are down from mid-500 lbs. calves by mid-October each year to mid- to upper-400 lbs. calves in mid-October in 2021 and 2022. That is approximately a 10-15% loss in calf weights because of drought.”

In many Western states, where the federal government owns the majority of land, drought has diminished any usable forage, with 42% of respondents reporting impaired use of public lands as prevalent or higher (down from 57% in summer 2022) and 71% reporting removing animals from rangeland due to insufficient forage as prevalent or higher (equal to summer 2022). Ranchers reliant on these lands have few alternatives for feed and can lose out on funds paid for grazing permits. Eighty percent of Nevada’s area and 63% of Utah’s is federally owned, creating particular hardships for ranchers in these areas. One Utah rancher wrote:

“Many livestock producers are not able to graze the entire season on winter Bureau of Land Management permits and as such will need to find other feed resources at a higher cost, reducing profitability. Many will reduce herd size to reduce expensive feed costs. Private land grazing is reduced as well, due to feed resource reduction on account of the ongoing drought.”

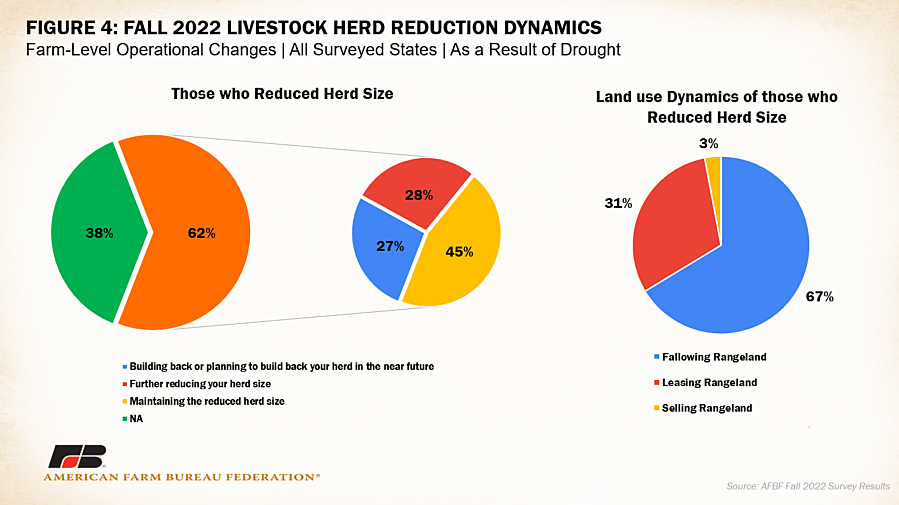

Respondents were again asked about land fallowing and herd management behavior if they had reduced or liquidated their inventories last year. Remember, back in summer of 2022, 67% of respondents reported reducing herd sizes in 2021, and nearly 50% were further reducing their herd or flock during 2022, 37% were maintaining the reduced herd size and only 14% were building their headcount back up. In this iteration of the survey, 62% of respondents reported reducing herd sizes in early 2022, and a much lower 28% reported they were further reducing their herd or flock. A much larger portion were maintaining the reduced herd size (45%) and a higher percentage were starting to build back their herd size (27%). The difference in respondents reporting further herd reduction is likely linked to most liquidation already having occurred by this period of data collection. Many respondents likely already sold off many of the animals they could. The higher percentage of respondents maintaining or growing herd sizes may signal the bottom of the cattle supply contraction, although any progression in the cattle cycle is dependent on future weather conditions. Thirty-eight percent of the total respondents did not reduce herd sizes last year or did not raise livestock. Additionally, of those 62% who reduced their herd sizes, 67% fallowed the rangeland that was no longer in use (down from 76%), 31% leased the land to another rancher (up from 22%) and only 3% sold the land (up slightly from 2%). The fact that more respondents reported leasing rangeland could signal improving pasture conditions in some regions, good enough to rent out to other ranchers. Smaller inventories of livestock across a region that supports over 70% of domestic beef production by value decreases supply and drives up prices for consumers.

Water Access

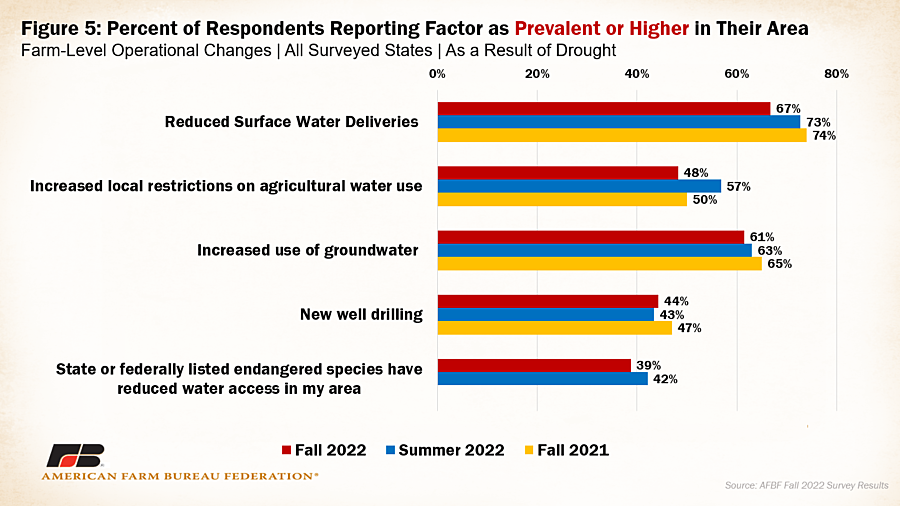

Reduced surface water deliveries and increased reliance on groundwater continue to be widespread, with regional surface water delivery expectations reported down 50% from normal (equal to summer 2022 results). These factors were highest in Nevada (reported down 63%), New Mexico (down 60%) and Texas and California (down 55%) and lowest in Washington (down 6%). Figure 5 summarizes results from the general water access factor section of the survey.

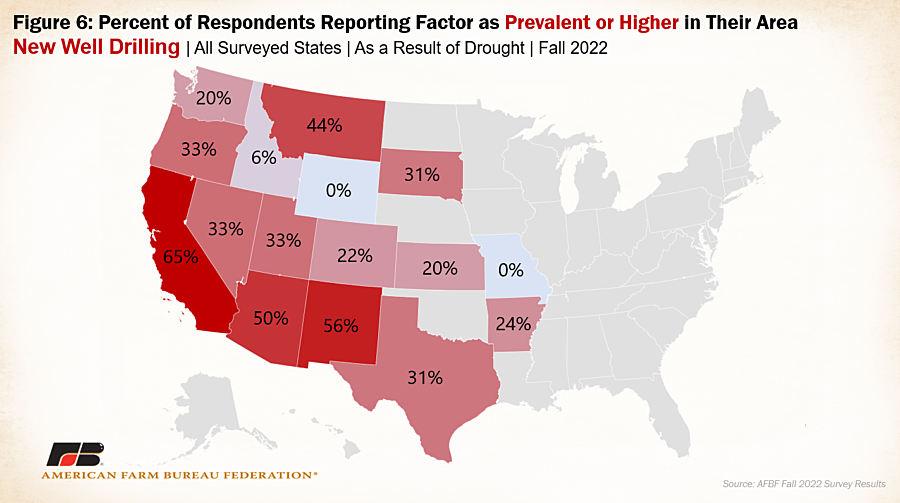

Over 60% of respondents continue to report increased use of groundwater resources (100% in Nevada and New Mexico), with 41% of producers reporting new well drilling in their area (65% in California).

For many farmers, new wells are too costly or cannot be drilled because of local or state regulations, with nearly 50% of respondents reporting increased local restrictions on agricultural water use. A Pinal County, Arizona, farmer described, “We cannot drill a well and have to pay a water assessment annually that is attached to our taxes even if there is no water available. This year the water portion was over $19,000. We are also not permitted to drill a well in our water district. The district is drilling a few wells to add to the surface water, but that water will not make it to our farm as the wells are too far away.” Respondents reported the cost to drill is up over 100%, costing $120,000-$150,000 to drill a 650-foot irrigation well. Some farmers cannot drill new wells due to other reasons such as soil salinity. A San Diego County, California, farmer noted, “I am not drilling wells because the water in my area is too salty and those who have wells regularly have to dilute it with city water anyway. So, other than rainfall, my only option is to use city water. I only water food crops on my land. I do not have lawns or fill ponds.”

One topic that frequently came up in the comments in this survey iteration was the impact of drought on local rural economies and the associated labor market. Many respondents reported having to lay off employees due to lack of work associated with drought conditions. Farmers mentioned not being able to hire seasonal staff that they had relied upon and became very close with over the years. A producer in Glenn County, California, shared, “Loss of employees, high levels of depression, possible insolvency in 2023.” Not only do disaster conditions contribute to direct supply losses in food production and farm revenue, they stunt the ability for others reliant on a thriving rural economy to earn incomes and pay for everyday necessities.

Conclusion

Many farmers and ranchers across the West continue to battle drought conditions. The ability to illustrate the severity of these conditions and their impact on agriculture with existing data is greatly limited. The results of AFBF’s fall 2022 Assessing Western Drought Conditions survey offer a window into operational-level hurdles farmers and ranchers face in coping with persisting water shortages. Most of these issues and adjustments negatively impact business income, putting the solvency of many farms and ranches at risk. For consumers, drought brings higher prices and scarcity of goods not grown in other regions. While some of this data appears to reveal regionally improving conditions, it will likely be many years before farm and ranch families across the West recover.