Let’s Get Going, 2024!

photo credit: North Carolina Farm Bureau, Used with Permission

Betty Resnick

Former AFBF Economist

A look at prospective plantings and grain stocks as we enter planting season

With ARC/PLC selections made, crop insurance sales closing dates passed and now the annual Prospective Plantings Report published – the 2024/25 planting season has officially arrived. Between Feb. 28 and March 16, USDA surveyed nearly 72,000 farms about planting intentions. As expected, due to softening commodity prices, farmers are intending to plant fewer acres of corn this year – moving to soybeans, cotton and other crops.

Principal Crops

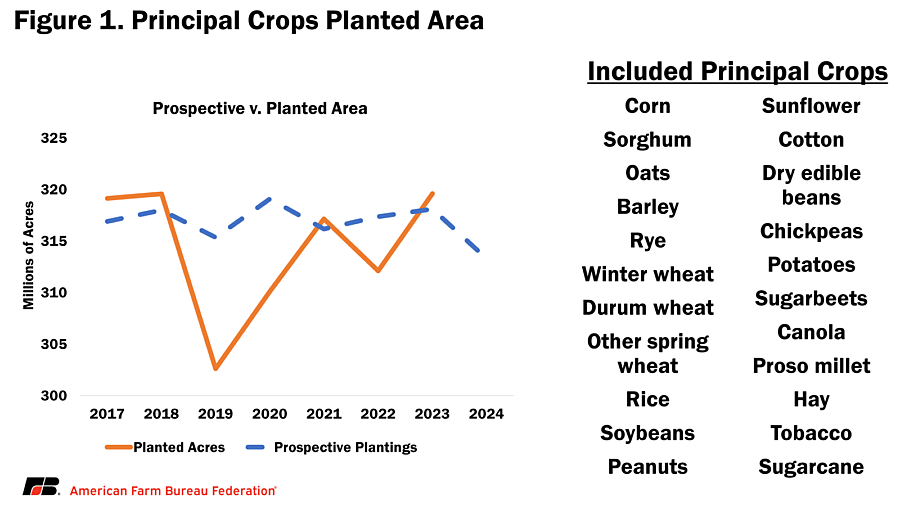

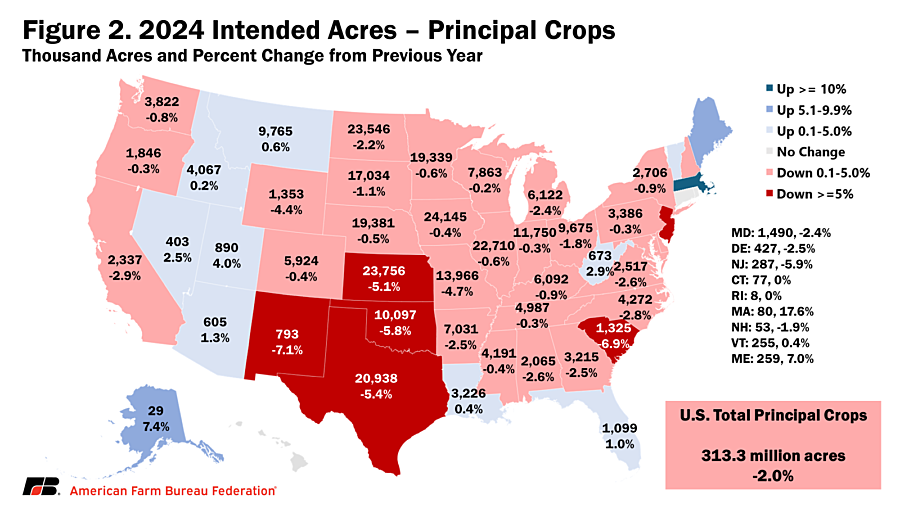

USDA’s definition of principal crops includes 22 crops ranging from corn to potatoes to proso millet. USDA surprised analysts and farmers alike by estimating total acres of principal crops at only 313.3 million acres, down 6.3 million acres (2%) from 2023 planted acres. The 2% drop in prospective planting crop acres is the largest to date in the eight years since the metric was introduced in 2017.

As depicted in Figure 1, if total planted acres come in above planting intentions, history suggests it tends to be a small increase of under 1%. Total principal crop prospective acres can be significantly above planted acres in years with significant weather events leading to more acres being enrolled in prevented planting. We will have to wait and see where those 6.3 million acres end up. Are they shifting toward unaccounted for crops? Are they being put into conservation programs? Is it land now being used for non-farming purposes, like residential or solar development? Will these acres show back up in later reports? Only time will tell.

Kansas and Texas lost the most acres, losing 1.3 and 1.2 million acres representing 5% of each states’ principal crop planted acres, respectively. Losses in the southern plains, including Kansas, Oklahoma, Texas and New Mexico, account for half (3.15 million) of the acres lost, and could be reflective of exceptional drought the region has faced in recent years. While recent wildfires could also be a factor, they do not account for the high levels of lost acres. Most impacted acres were grassland/pasture and USDA estimates only 18,700 acres of crops were within the Texas wildfire perimeters.

On a percentage basis, New Mexico and South Carolina lost the most acres, each losing 7% each of their planted acreage. If realized, South Carolina, Georgia and Pennsylvania will have a record-low number of principal crops planted acres. Of the 49 states included in the survey, 37 lost acreage. Of the 12 states that gained acreage, Montana gained the most (57,000) and Massachusetts had the highest percentage increase at 18%, representing an additional 12,000 acres. Alaska is on track to have a record number of acres in principal crops, reaching 29,000 acres.

Corn

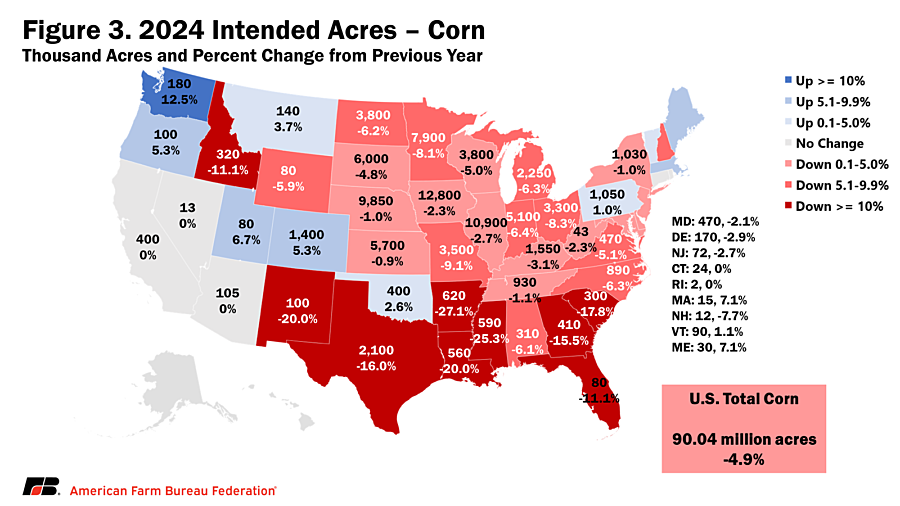

The headline of the prospective plantings report was a larger-than-expected reduction in corn acreage. In 2024, farmers intend to plant 90 million acres of corn – a 4.9% year-over-year reduction, and approximately 1 million acres below industry expectations headed into the report. Thirty-eight out of 48 surveyed states (79.1%) saw a reduction in corn acreage, with the Mississippi Delta region and the South in general having the largest reduction on a percentage basis. Minnesota had the largest reduction in corn acres, falling 700,000 acres (8.1%). Corn prices have been on a steady decline, falling 26.6% from $6.54 to $4.80 per bushel between the 2022 and 2023 crop years. Projections from the USDA Agriculture Outlook Forum forecast a further decline in 2024, falling an additional 8.3% to $4.40 per bushel.

Soybeans

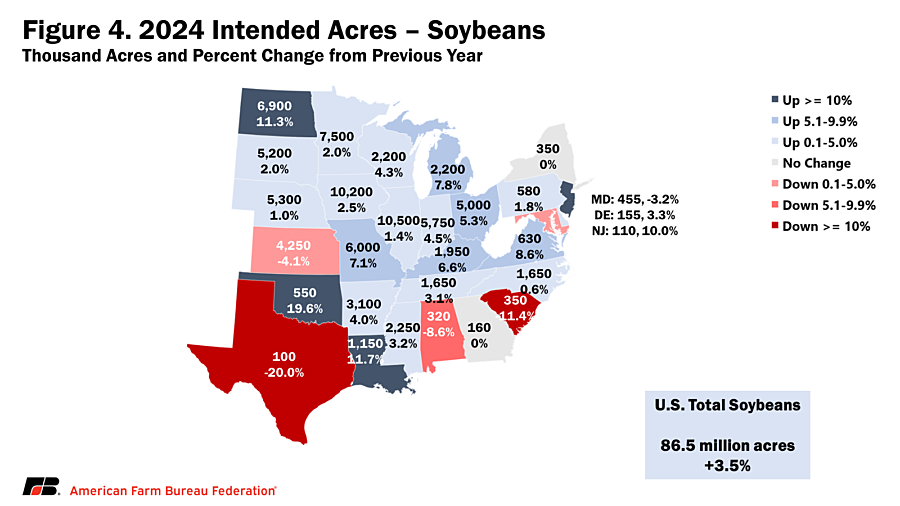

As expected, farmers intend to plant more soybeans in 2024 – adding 2.9 million acres and increasing acreage by 3.5%. This is driven by soybeans being a lower-cost crop to produce compared to corn with lower input requirements. Also, in times of uncertain commodity prices and liquidity concerns, soybeans are often viewed as a sensible, less-risky alternative. Of 29 soybean producing states, 22 (76%) intend to increase soybean acreage in 2024. North Dakota had the largest intended increase, planting an additional 700,000 acres of soybeans representing an 11.3% year-over-year increase. Soybean prices have also been on a steady decline, falling 10.9% from $14.20 to $12.65 per bushel between the 2022 and 2023 crop years. Projections from the USDA Agriculture Outlook Forum forecast a further decline in 2024, falling an additional 11.4% to $11.20 per bushel.

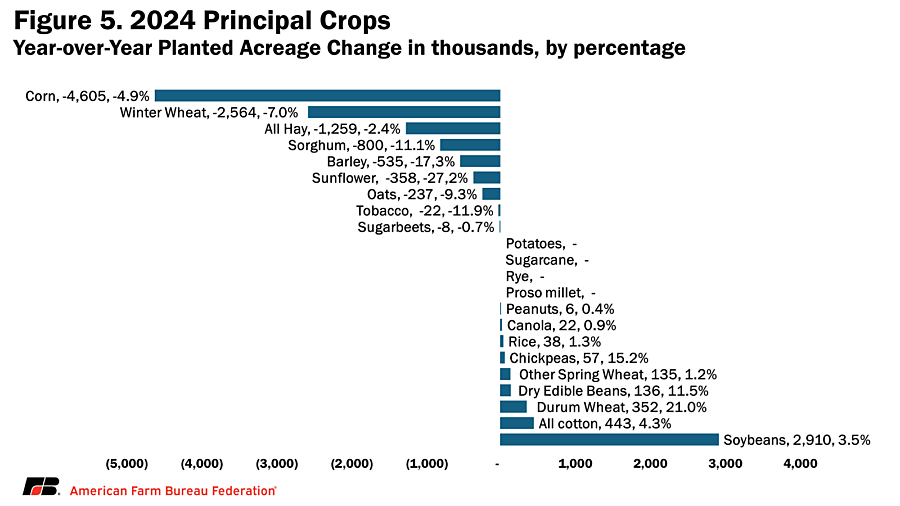

Crop Mix

While corn is the largest factor in declining acres with a loss of 4.6 million acres, winter wheat (2.6 million), hay (1.3 million), sorghum (800,000) and barley (535,000) each have declines of more than half-a-million acres. Among crops gaining acres, soybeans dominate – gaining 2.9 million acres, followed by cotton (443,000) and durum wheat (352,000). On a percentage basis, durum wheat (+21.0%) and sunflowers (-27.2%) showed the largest swings among all principal crops.

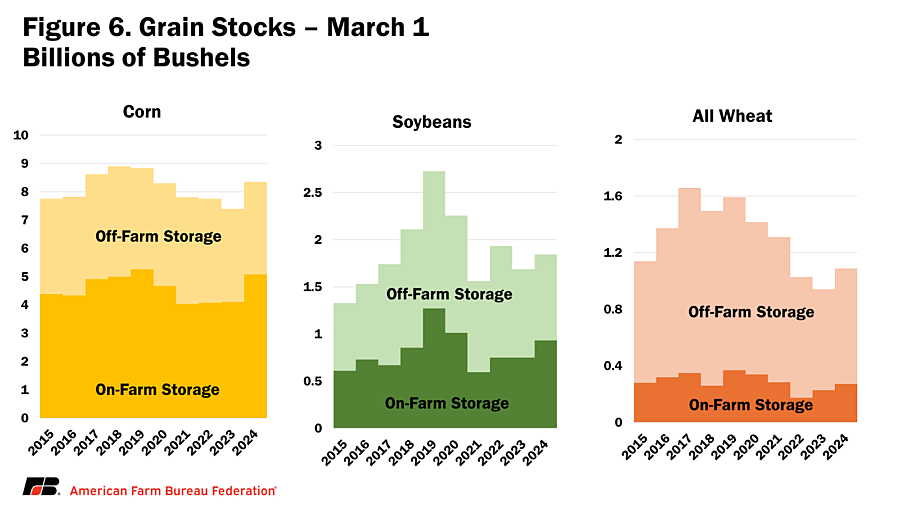

Quarterly Grain Storage Report

In addition to prospective plantings, USDA released its Quarterly Grain Stocks report. The report is built on two surveys capturing both on- and off-farm grain storage. Corn stocks totaled 8.35 billion bushels on March 1, 2024 – up 13% from March 1, 2023. This increase in stock is entirely driven by on-farm storage, with off-farm stocks decreasing by 1%. Soybeans are in a similar position, with a year-over-year increase of 9% reaching 1.85 billion bushels on March 1, 2024, again entirely driven by on-farm storage. All wheat stocks have increased 16% year-over-year, with 1.09 billion bushels of wheat in storage on March 1, 2024. For wheat, stock increases were recorded in both on-farm (20%) and off-farm (14%) storage.

Compared to industry expectations going into the report, corn stocks were on the low end, soy stocks were on the high end and wheat stocks were above all forecasts.

Looking Ahead

The March 28 reports were bullish for corn, with both stocks and acreage coming in below industry expectations. This was reflected in the markets – with May corn futures (old crop) up 15 cents to $4.42 per bushel and December corn futures (new crop) up 16 cents to $4.78 per bushel on the day the report was released. The report proved neutral for soybeans, with more limited market movement.

Moving forward, the most significant story from these reports will be the loss of principal crop acreage. If it holds true, meaning there isn’t an increase in acreage in the June plantings report, it could be indicative of a retraction in acres due to a myriad of reasons. If planted acres end up higher than current intentions, it is still a marked sign of pessimism among farmers as we enter the 2024/25 growing season.

Top Issues

VIEW ALL