Mapping $8.5 Billion in Trade Assistance

photo credit: AFBF Photo, Mike Tomko

Allison Wilton

Economic Analysis Intern

John Newton, Ph.D.

Chief Economist

In response to U.S. tariffs on imported solar panels, washing machines, steel and aluminum, as well as additional products from China, e.g., Tariff Revenues Up Sharply, many of our largest trading partners responded by retaliating on U.S. agriculture products including but not limited to tobacco, soybeans, dairy products, feed grains, pork, fruits and tree nuts. These retaliatory actions included the cancellation of supply contracts, higher tariffs and other non-tariff barriers. Many U.S. farmers lost access to foreign markets, resulting in increased inventories of some U.S.-produced commodities in 2018.

To help U.S. farmers and ranchers deal with lost markets, and to provide immediate financial relief, in August 2018 the administration announced a trade assistance package totaling $12 billion, with $200 million in funding for agricultural trade promotion programs, $1.4 billion in food purchasing and distribution programs and $9.4 billion in direct payments to producers, Trade Aid Round One: A State Perspective.

Farmers who grow corn, cotton, sorghum, soybeans, wheat, dairy, hogs, shelled almonds and fresh sweet cherries were eligible for program benefits with sign-up originally slated to close Feb. 14, 2019; the deadline for trade assistance payment applications was ultimately extended to mid-May. Producers were eligible to sign up when all product was harvested, or after Sept. 4, whichever came first.

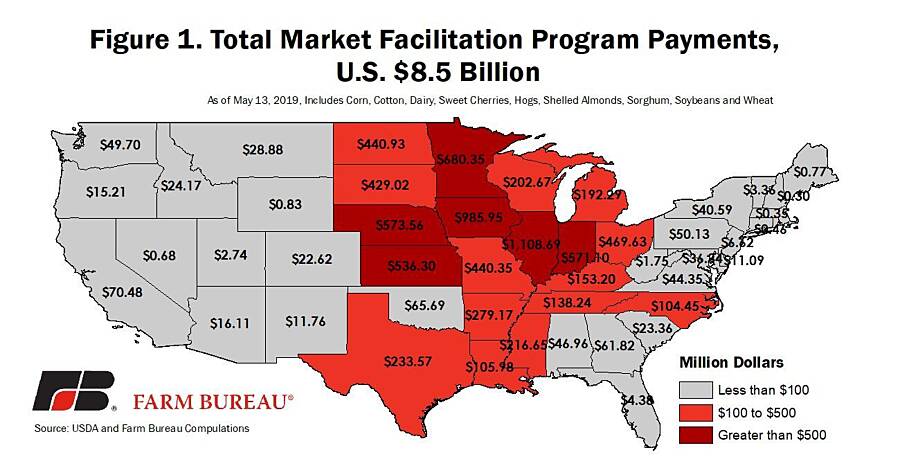

Total Market Facilitation Program Payments

As of May 13, approximately $8.504 billion had been paid out in MFP payments – representing 90% of the original direct payment allocation. MFP payments were the highest in Illinois, Iowa, Minnesota, Nebraska and Indiana, which, when combined, represented 46% of all program payments. Soybeans, hit hardest by the loss of exports, received the largest portion of payments, followed by cotton and sorghum. Figure 1 identifies total MFP program payments by state as of May 13.

Soybeans

Retaliatory tariffs drove U.S. soybean exports down by 20% in 2018. Through April 2019 exports are down 7%. To China, specifically, soybean exports were down 74% and 26% percent in 2018 and 2019 year-to-date, respectively. In total, soybean export sales to China dropped by nearly $10 billion since the imposition of retaliatory tariffs.

Taking the biggest hit in this trade tit-for-tat, it was appropriate that soybean farmers received the majority of direct payments. With an average payment rate set at $1.65 per bushel, payments to soybean producers totaled $7 billion as of May 13 and represented 83% of total payments under the MFP program. Payments were the highest in Illinois, Iowa, Minnesota and Indiana – representing 44% of soybean MFP payments and equivalent to just over $3 billion.

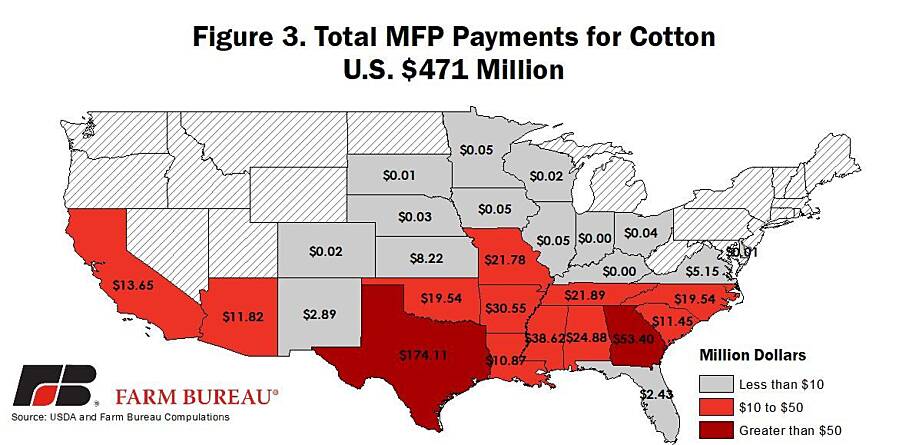

Cotton

Overall cotton exports in 2018 were up 12%, however, exports to China were down 6% year-over-year. Year-to-date in 2019, cotton exports are down 20%, with exports to China plummeting 48%. Overall, in 2019 cotton exports are down more than $500 million dollars compared to prior-year levels. To offset the lower export sales and the loss of critical markets, cotton producers received payments totaling $471 million, with a payment rate of 6 cents per pound. These payments to cotton producers represented 6% of all MFP payments. Texas was the top recipient of cotton payments, followed by Georgia and Mississippi. Those three southern states accounted for 56% of all cotton payments, equivalent to approximately $266 million.

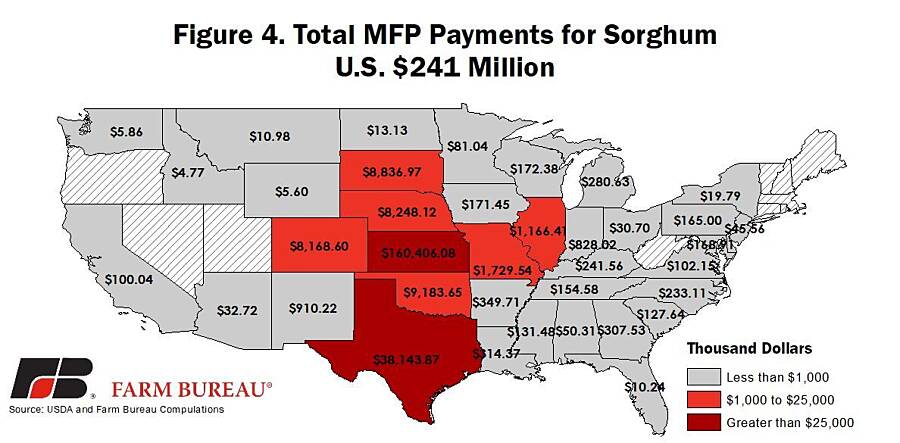

Sorghum

At one point more than 90% of sorghum exports were destined for China, e.g., China Continues to Drive Sorghum Acreage and Consumption, but following China’s investigation into sorghum exports, launched in April 2018, sales to China dropped sharply, In Sorghum Trade, Words Count. During 2018, sorghum exports fell by nearly 22% and year-to-date in 2019 sorghum exports are down nearly 80%. Sorghum exports to China in 2019 have fallen by 100%. Due to these trade headwinds, sorghum producers received $241 million in payments with a rate of 86 cents per bushel – 3% of total MFP payments. Kansas received 67% of sorghum payments at over $160 million, followed by Texas at $38 million and Oklahoma at $9 million.

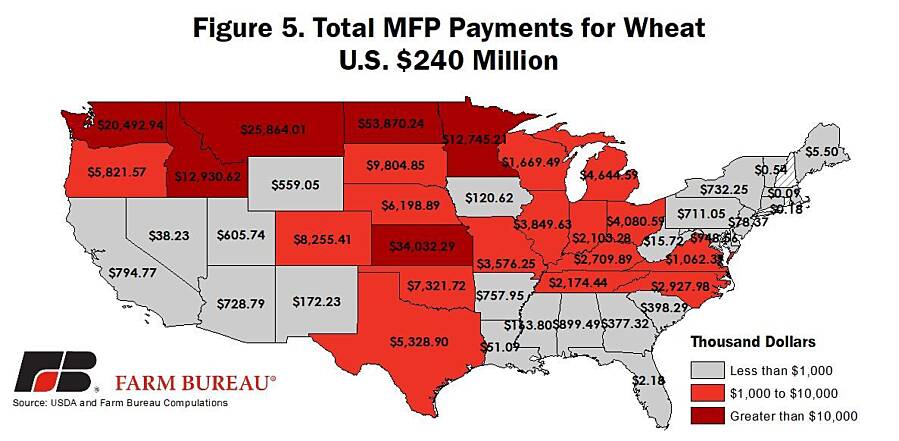

Wheat

Wheat exports in 2018 were down 11%, or more than $600 million. While overall wheat exports through April 2019 are higher, exports to China are down nearly 90%. To address trade issues for U.S. wheat producers, MFP payments totaling $239.9 million were delivered to producers at a rate of 14 cents per bushel. This accounts for 3% of all MFP payments. The top recipients were North Dakota, Kansas and Montana. These three states received a combined $113.7 million, or 47% of all wheat trade assistance payments.

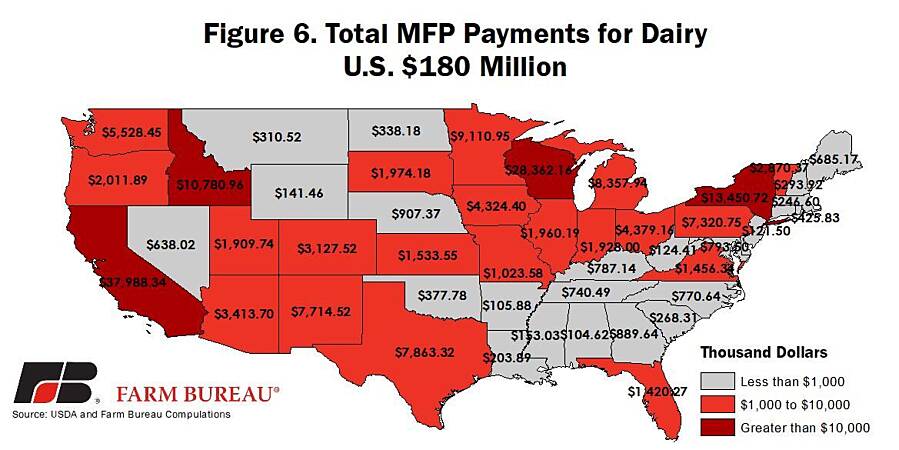

Dairy

Up 2% and worth $5.5 billion, milk and dairy product exports were the highest in three years in 2018. The slightly upward trend is continuing in 2019. Specifically, exports to Canada and Mexico through April 2019 were up 6%. However, exports to China, which reached $76 million in 2018, are down 34% through the first four months of 2019. The National Milk Producers Federation and the U.S. Dairy Export Council estimated dairy’s losses at $1.5 billion in 2018 due to retaliatory tariffs. That said, dairy farmers received 2% of all MFP payments at approximately $180 million, representing an average payment rate of 12 cents per hundredweight.

All states received dairy MFP payments, with the top recipients being major dairy states such as California, Wisconsin, New York and Idaho. The total value of payments to dairy farmers in those four states was nearly $91 million, representing 50% of dairy payments. It is important to note that during 2018 and year-to-date in 2019, the Margin Protection Program and Dairy Margin Coverage program will deliver program payments to producers – partially offsetting the lower MFP program payments, e.g., Dairy MPP Is Delivering in 2018 and Reviewing Dairy Margin Coverage.

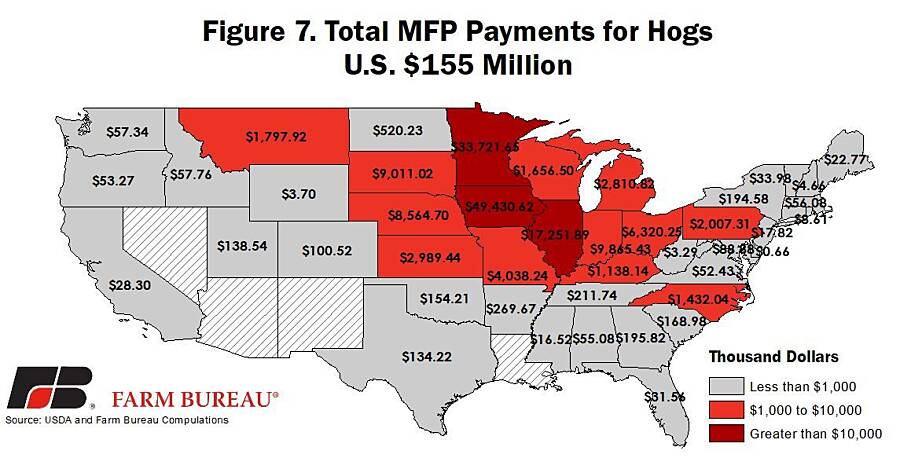

Hogs

Frozen pork exports to China fell by 16% in 2018 and are down 25% year-to-date in 2019. In response to the slowdown in trade to China and tariffs in other top markets, the administration allocated $581 million in direct payments to hog farmers, ultimately delivering approximately $155 million in payments. Combined, 45 states received a total of $154.8 million in MFP payments for hogs at a payment rate of $8 per head. Major pork producer Iowa received over $49 million in payments, which was 32% of all pork payments. Hog payments amountedto2% of all MFP payments so far. While pork producers received a smaller share of direct payments, of the $1.2 billion allocated for food distribution programs, pork was allocated $559 million.

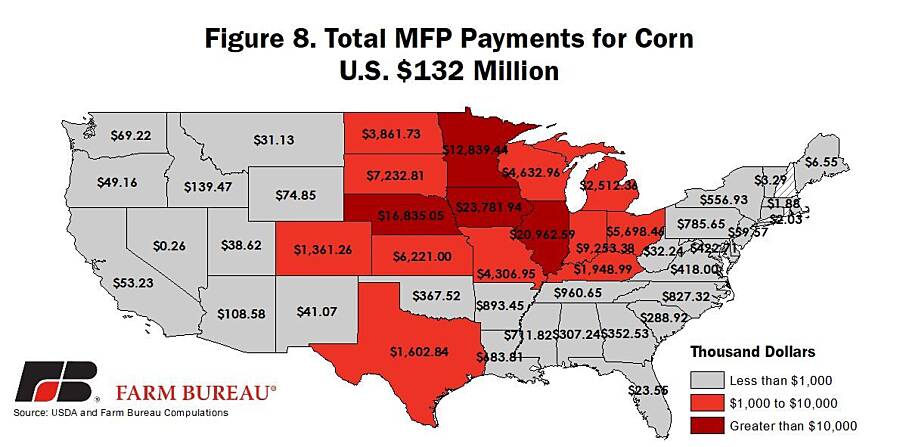

Corn

Corn exports during 2018 were a record-high $12.5 billion, but signaling a slowdown, year-to-date data shows a decrease in corn exports by 11% through April 2019. Corn exports to China in 2018 saw a loss of $91 million, a decrease of nearly 65%. To reconcile these losses, corn producers received a total of $132 million with a rate of $1 cent per bushel as of December 2018 - around 2% of all MFP payments. Farmers in all states except Hawaii, New Hampshire and Rhode Island received payments. The Corn Belt led the way in most payments received, with Iowa, Illinois and Nebraska receiving $61.6 million, or 36% of total corn payments.

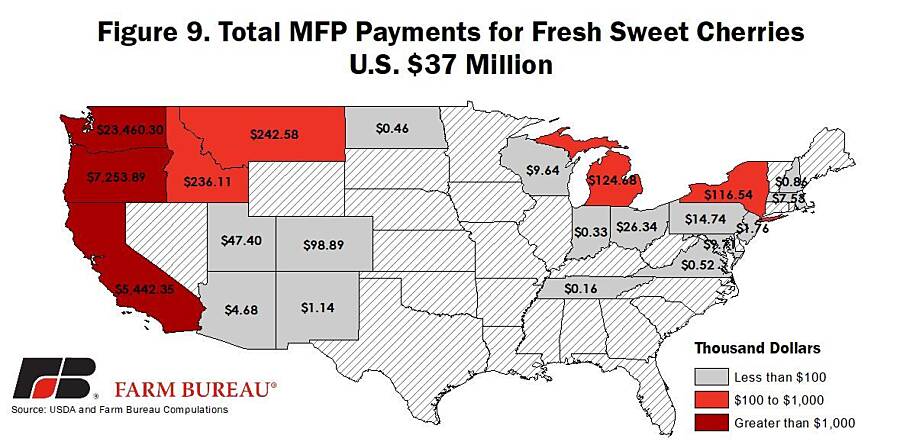

Fresh Sweet Cherries and Shelled Almonds

Fresh fruit exports dropped almost $1 million in 2018 and have decreased by 20% through April 2019. Year-to-date data shows fresh fruit exports to China down by 33%. Added later in the sign-up process, fresh sweet cherry payment rates were set at 16 cents per pound, with a total of $37 million paid out so far. The West Coast states received 97%, or $36 million, of the cherry payments. Total cherry payments accounted for less than 1% of all payments under MFP. Tree nut exports to China are down 6% to $78 million, the lowest in five years. With only Oklahoma, Texas and California receiving payments for shelled almonds, the total amount paid was $12.3 million, or 0.15% of all MFP payments.

Summary

In response to retaliatory tariffs, many of our largest trading partners placed on U.S. agricultural products, in 2018 and 2019 the administration provided much-needed direct payments to farmers and ranchers. The first aid package, announced in 2018, has paid farmers more than $8.5 billion as of May 13, and may potentially pay more given modifications in the recently passed disaster bill, What to Expect in the New Disaster Aid Package.

These direct payments are no replacement for lost markets – but they do help farmers and ranchers meet immediate financial needs. With the farm economy down nearly 50% in recent years, farm debt at record highs and more natural disasters, U.S. farmers and ranchers need access to our hard-earned agricultural markets restored. Always preferring trade over aid, U.S. farmers, ranchers and agribusinesses stand ready to serve their customers abroad.

What We're Saying

Trump Administration Pauses Reciprocal Tariffs for 90 Days

Apr 10, 2025

READ MORE

Farm Bureau Appreciates Pause in Reciprocal Tariffs

Apr 9, 2025

READ MORE

U.S. Imposes Reciprocal Tariffs on Trading Partners

Apr 3, 2025

READ MORE

Additional Tariffs will Take Toll on America’s Farmers

Apr 2, 2025

READ MORE