May WASDE Offers First Look at Upcoming Marketing Year

Betty Resnick

Economist

USDA’s May World Agricultural Supply and Demand Estimates report is a first look at the new crop year’s supply and demand balance sheets. However, with planting still in progress in the Northern Hemisphere and old crop harvesting still occurring in the Southern Hemisphere, projections this early in the year are highly uncertain, putting the focus on projections for ending stock levels.

For the domestic 2024/25 crop, which is currently being planted in most of the country, supply projections for most crops are based on farmer planting decisions from the March Prospective Plantings report and trend yield models. This WASDE report’s projections have not taken into account slow planting progress due to wet conditions in the Midwest, which could decrease future U.S. production projections if late planting occurs.

New Crop – 2024/25 Marketing Year

Corn

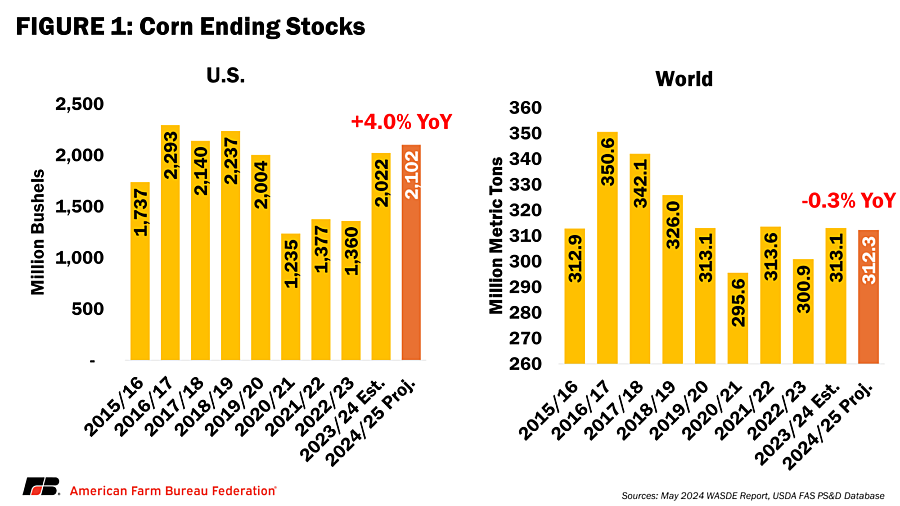

For the 2024/25 marketing year, USDA projects U.S. corn ending stocks at 2.102 billion bushels, up 4% (80 million bushels) from 2023/24. The current new crop corn projection came in below industry expectations and almost 17% below estimations from the USDA Agricultural Outlook Forum in February. With the loosening domestic market, USDA projects the average market price to fall to $4.40/bushel, down 5.4% from 2023/24. Globally, we can expect corn ending stocks to hold steady in 2024/25 – falling only 0.3% due to lower production.

Overall, the corn market in 2024/25 is looking less bearish than it did when farmers were making planting decisions a few months ago. USDA raised both old crop and new crop corn demand (total use) by 100 million bushels each. Projections for total use in the 2024/25 marketing year of 14.8 billion bushels represent a 1.1 billion bushel increase over 2022/23, bouncing back to near-record levels set in 2021/22 at 14.9 billion bushels. December corn futures responded by moving 11 cents higher with positive follow through on Monday.

Soybeans

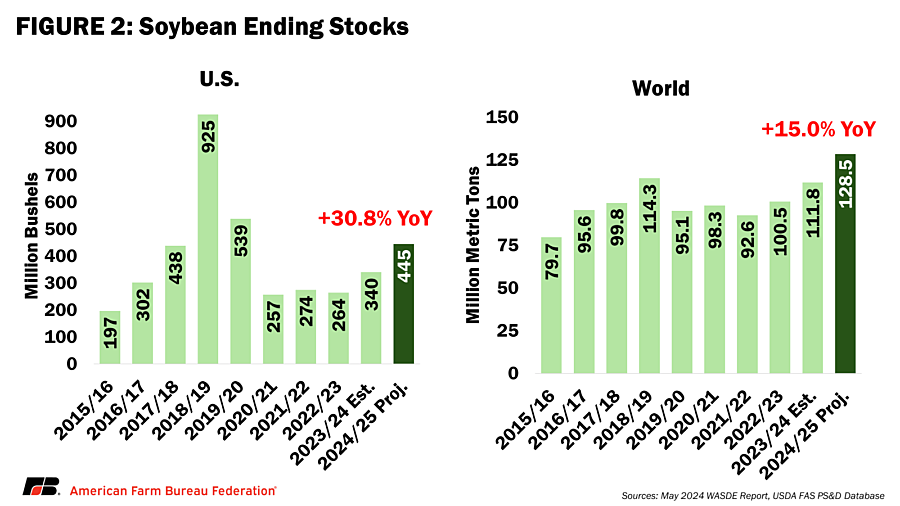

While the 2024/25 corn market is looking less bearish, the opposite is true for soybeans. In the upcoming marketing year, U.S. soybean ending stocks are projected at 445 million bushels, higher than both trade expectations and the USDA Agricultural Outlook Forum estimates in February. As compared to the current 2023/24 marketing year, this represents a whopping 30.8% increase. Due to this large projected increase, USDA projects prices to fall to $11.20 per bushel, a year-over-year decrease of 10.8%.

Globally, there is a similar but more muted situation for soybean ending stocks, with a year-over-year projected increase of 15%, rising up to 128.5 million metric tons (MMT). Brazilian production is projected to increase 15 MMT (9.7%) to 169 MMT in 2024/25, and Brazilian exports are projected to increase 3 MMT (2.9%) to 105 MMT.

The estimations for soybeans are heavily reliant on continued growth in soybean use, with an estimated 125-million-bushel increase in both crushings and exports, representing increases of 5.4% and 7.4%, respectively. If demand does not hold firm for soybeans, it could turn more bearish very quickly.

Wheat

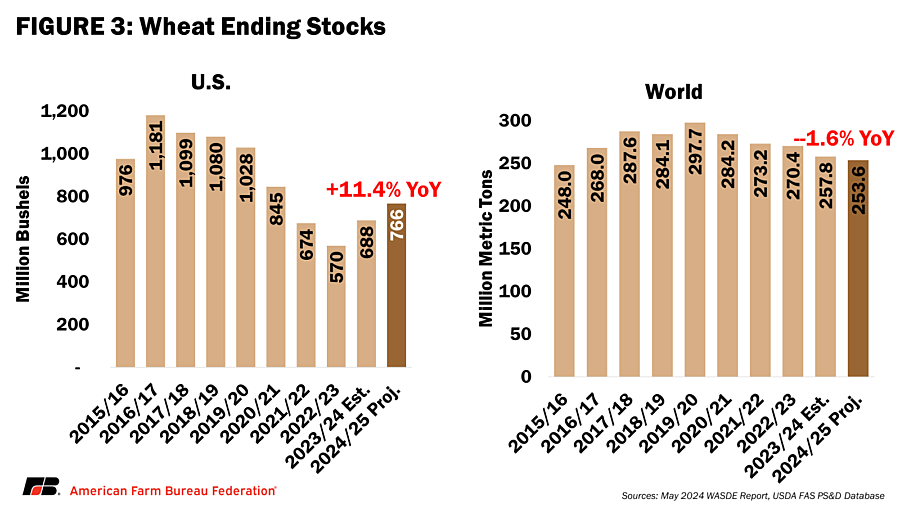

Wheat is a bright spot of the report, with projections of a tightening global market in 2024/25. Domestically, ending stocks are projected to increase 11.4% to 766 million bushels, based on increased production (+2.5%) attributed to improved growing conditions. While domestic production is forecasted to increase in 2024/25, it will still be the eighth-lowest harvested-to-planted acre ratio for winter wheat. When compared to 2023 (second lowest on record) and 2022 (fourth lowest on record), the picture is rosier.

USDA projects global wheat to have the lowest ending stocks in eight years – falling 1.6% year-over-year to 253.6 MMT. Despite the tightening global market – U.S. average farm prices for wheat are projected to decrease to $6, a 15.5% drop from the 2023/24 marketing year.

Cotton

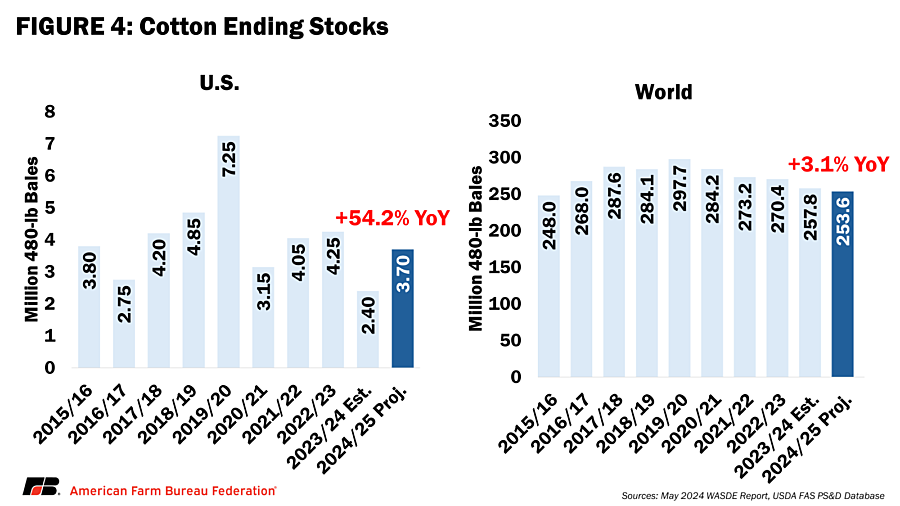

In the 2024/25 marketing year, cotton ending stocks are projected to increase over 50% domestically to 3.7 million 480-lb bales, and 3.1% globally to 253.6 million 480-lb bales. The large increase in domestic ending stocks is attributable to a projected 32.6% increase in production. Despite the large increases in supply, the average farm price of upland cotton is only projected to fall 2 cents (2.6%) per pound.

Conclusion

The 2024/25 crop year is projected to have lower average farm prices for all nine row crops with a price reported on the May 2024 WASDE. This includes medium/short grained rice (-16%), wheat (-15%), barley (-14%), soybeans (-13%), sorghum (-11%), long grained rice (-10%), oats (-10%), corn (-8%), and cotton (-3%). While there was some better-than-expected news in the May 2024 WASDE, especially for corn and wheat, overall declining prices underpin building pessimism in farm country.