Quarterly Hogs & Pigs Report – Hog Markets Will Need Strong Demand to Bring Better Prices in 2023

photo credit: AFBF Photo, Cole Staudt

Bernt Nelson

Economist

From global disease pressure to national and international economic uncertainty, the theme of pork markets in 2022 was volatility. Hog markets have started out much quieter in 2023 but there is no shortage of issues impacting producers. USDA released the Quarterly Hogs & Pigs report on March 30, 2023. This is the first of four big quarterly reports for pork producers containing inventory and breeding information for each of the 16 largest hog producing states accounting for 95% of the total U.S. inventory. This Market Intel will provide analysis of the report and what it means for the rest of the 2023 pork marketing year.

The Report

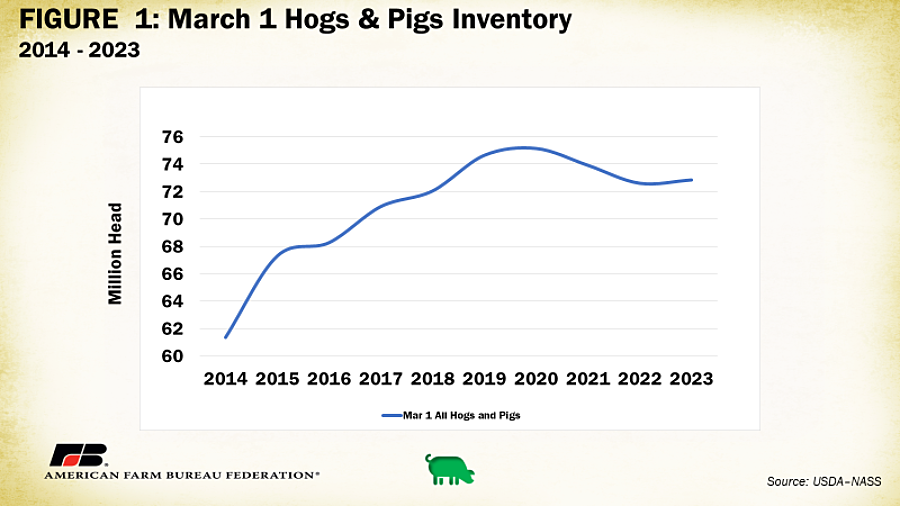

All hogs and pigs in the United States on March 1, 2023, totaled 72.9 million. This was up only slightly from March 1, 2022, but was adjusted down 2% from USDA’s fourth quarter report released Dec. 23, 2022. Weekly sow slaughter through mid-March 2023 has remained slightly higher than 2022, which made analyst expectations for the breeding inventory near 100% for this report. The breeding inventory was 6.13 million, up slightly from this time in 2022, but down slightly from the previous quarterly report. The Dec.-Feb. 2023 pig crop was estimated to be 32.1 million, which is up slightly from last year. This increase can be attributed to the gentle increase in farrowing sows, which also tracks with the slight increase in breeding inventory. Industry leaders in the pork business were looking for lower inventory numbers from this report. Inventory numbers near 100% across the board make this report neutral to bearish for hog markets.

Production

USDA estimated total pork production during February to be 2.16 billion pounds, down 1% from 2022. March hog slaughter totaled 9.97 million head, up slightly from February 2022. The average live weight was 291 pounds, down 2 pounds from 2022. Weekly sow slaughter for 2023 is coming in slightly higher than a year ago with weekly numbers holding just about 60,000 through mid-March. Increased marketings of sows would be an early indicator of shrinking inventory numbers but it is too early to tell if that trend will begin to develop.

Cold Storage

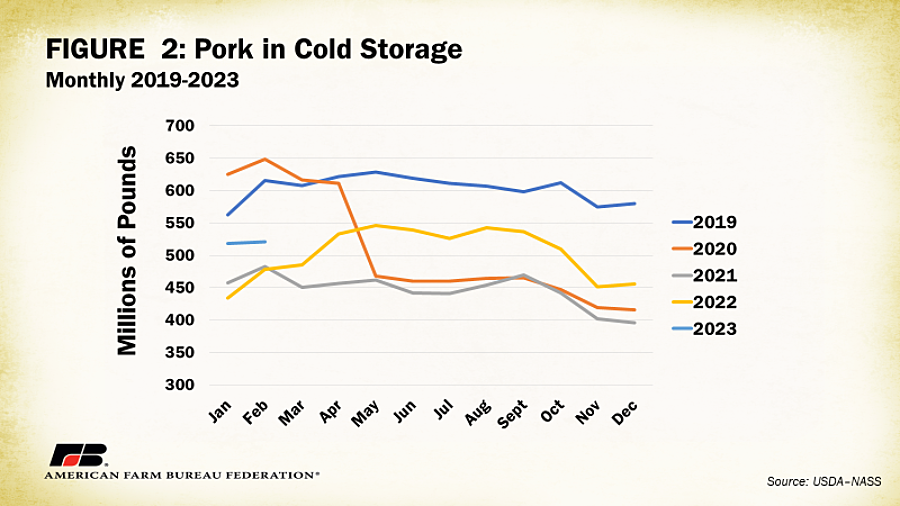

Total red meat in cold storage dropped 3% or 28.4 million pounds, to 1.05 billion pounds in February. This is still about 2% above February of 2022. Frozen pork stocks increased only slightly to 521.2 million pounds but is about 9%, or about 42.9 million pounds, greater than February 2022. Figure 2 presents a clear illustration that U.S. pork has had ample supply to rebuild cold storage stocks after the major drop brought on by the COVID-19 pandemic.

Demand

During the COVID shutdowns, consumers cooked a lot more and developed a preference for beef. While inflation has driven up the price of food at home in 2022, packers were processing large amounts of beef leading to a strong supply. This has helped keep retail prices down. In fact, the Bureau of Labor and Statistics’ February Consumer Price Index release reported the price of all-fresh retail beef fell 1.4% compared to February 2022. While a few other pork products also saw a small price drop, all-fresh beef was the only food item category that showed a lower overall price index for the month of February. This has kept domestic demand for beef strong.

Despite the slight drop in prices, domestic demand for pork products has been limited. USDA estimated pork disappearance to be about 51.4 pounds per capita in its February Livestock, Dairy and Poultry Outlook. This is a gain of about 0.4% from 51.2 pounds per capita in 2022. Traditionally, this is the time of year domestic pork demand begins to increase. This begins with ham sales and moves to other cuts that are preferred for grilling as we head towards Memorial Day and summer months.

Exports

Export demand will be a spotlight factor affecting hog prices in 2023. In 2022, the U.S. exported about 2.67 million metric tons of pork worth $7.65 billion. Export volume was down about 8.5% while overall value was down about 5% from a record setting year in 2021. U.S. Dollar strength makes it more expensive for other countries to buy our products. In the same way, when the currency of other countries strengthen it makes our products cheaper to buy. The Mexican Peso has recently increased in value relative to the U.S. dollar giving U.S. export sales to one of our most important trading partners a boost.

Mexico has been a standout trade partner for U.S. pork in recent years and 2022 was one of the best years yet. Last year, pork exports to Mexico were a record-breaking 959,701 metric tons, up 10% from 2021, and valued at over $2 billion, up 21% from 2021. Exports to Mexico for the week of March 30, 2023, were massive at 62,700 metric tons. USDA expects Mexico’s pork production to increase by 4.6% (70,000 metric tons) while imports are forecasted to fall 2.7% (40,000 metric tons) for 2023. Export sales to Mexico to date are 172,900 metric tons, or about 2.5% behind this time in 2022.

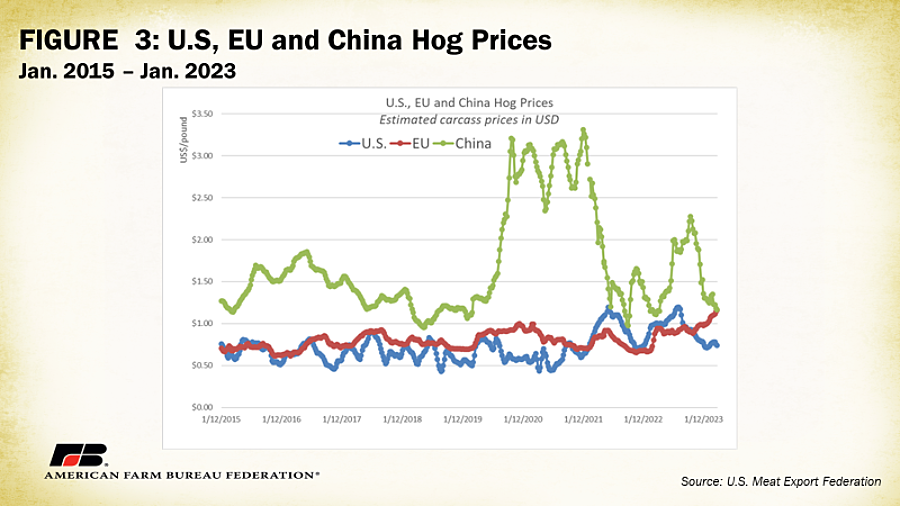

According to the U.S. Meat Export Federation (USMEF), U.S. pork has just recently become the least expensive among U.S., China and the European Union (EU). As a result, South Korean imports of U.S. beef increased 26% in January and put the U.S. on top as their number one source of pork (Figure 3). Accumulated 2023 pork exports to South Korea are currently 32,100 metric tons, with 85% of 2023 accumulated sales occurring the week of March 23.

Pork exports to China were slow through most of 2022 but finished the year strong with 56,230 metric tons in December, up 66% year over year. Overall, pork exports to China finished the year at 542,443 metric tons, down 26% from 2021.

China’s meat & poultry imports in Jan-Feb 2023 totaled 1.257 million metric tons, up 21% from the same period last year. Overall pork exports to China for Jan.-Feb. were 33,200 metric tons, up 16% from the same time in 2022. Total export sales of pork to China were 54,100 metric tons as of March 30, 2023, up 14% from 47,300 metric tons in 2022. Export sales to China for the same week were huge at 33,000 metric tons.

China and Mexico’s purchase of U.S. pork this week is likely a response resulting from U.S. pork being a bargain compared to other sources like the EU. These large purchases may be an indication of sparked demand for U.S. pork in the global market, but it is important that China still has a 25% tariff in place for U.S. pork.

Prices

Cash

In the February Livestock, Dairy, and Poultry Outlook, USDA forecasts National base lean hog prices, live equivalent to average $66.50/cwt for 2023. This is down about 6% from $72.21/cwt in 2022. The national daily base lean carcass cost for a 51-52% lean hog was $73.54/cwt for the week ending March 31, 2023. This is down 27% from $100.34/cwt during the same time in 2022.

Futures

Futures have continued to slide since finding contract highs in early January. June 2022 lean hog futures closed at $108.57/cwt on April 6, 2022, about 18% higher than the $88.17/cwt close on April 6, 2023. While we are approaching a traditional seasonal low for lean hog futures in mid-April, domestic demand will need to increase before strength in futures returns.

Other Issues

African Swine Fever (ASF) is continuing to be an issue in both European and Asian hog herds. The Philippines, among 12 other countries in Southeast Asia, has fallen victim to widespread ASF outbreaks. The status of the virus in China is a topic of controversy with some analysts expecting infections affecting as high as 50% of hog herds, while others believe there is survey evidence to support cases may have fallen during March. The disease has never been detected in the United States. USDA has recently announced partnerships with the National Association of State Departments, National Pork Board, and National Pork Producers Council to further improve ASF prevention efforts.

Summary

The hog market in 2023 has been much quieter than 2022. USDA’s Quarterly Hogs & Pigs report, which announced that the hog inventory is 100% of last year, had little bullish news for the 2023 market. Domestic demand has been sluggish, but U.S. pork has recently become the bargain in town and major trading partners like China and Mexico have responded by making large purchases. Both 2023 cash and futures prices have been well below 2022 levels and need a serious increase in demand to rise in the remainder of the 2023 marketing year.