(Seed) Cotton is Back in the Farm Bill

TOPICS

Market Intel

photo credit: Arkansas Farm Bureau, used with permission.

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

Cotton was removed as a covered commodity in the 2014 farm bill. Since then, Congress and industry stakeholders have been working to reintroduce cotton as a covered commodity in the farm bill, with the goal of providing risk management and commodity payment support to growers.

Congress, recognizing the need to provide risk management support to cotton producers, in the Bipartisan Budget Act of 2018 made cotton producers eligible for Title I farm programs by designating seed cotton, i.e. a combination of both cotton lint and cottonseed, a covered commodity effective for the 2018/19 marketing year. The reference price for seed cotton was set at 36.7 cents per pound, and for this crop year cotton producers who own generic base acres can now enroll in either the Agriculture Risk Coverage or Price Loss Coverage farm safety net program.

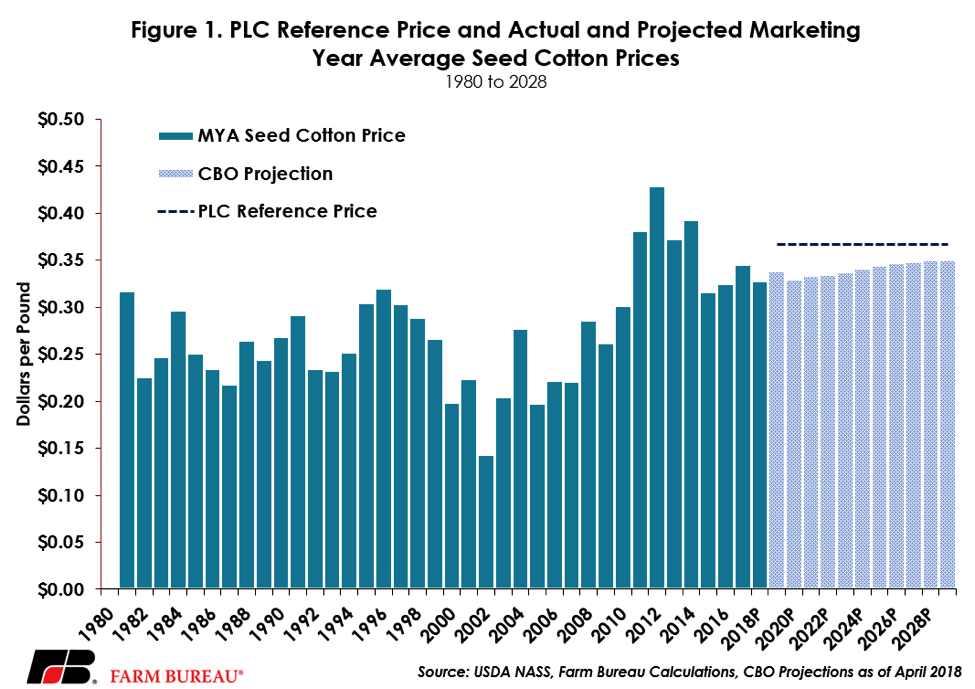

While farmers will have a one-time opportunity to choose between ARC and PLC, it is widely assumed that cotton producers with base acres will enroll in PLC. PLC is a price-based commodity assistance program with payment rates that depend on the difference between the marketing year average crop price and a target reference price. For seed cotton, PLC payments will be made if the marketing year average price falls below 36.7 cents. PLC payments are capped at 11.7 cents and represent the difference between the reference price and the loan rate for seed cotton of 25 cents per pound. Currently, for the 2018/19 marketing year, USDA’s Farm Service Agency projects a marketing year average seed cotton price of 36.37 cents per pound and a program payment of 0.4 cents per pound.

The marketing year average seed cotton price is a weighted average price based on upland cotton and cottonseed prices. The prices are weighted based on the combined production value of cottonseed and lint, and the total production volume of cottonseed and lint. For example, for the 2016 crop year, upland cotton production was valued at $5.4 billion and cottonseed production was valued at $1.1 billion, for a total value of $6.5 billion. Total production of lint and cottonseed totaled 18.7 billion pounds, resulting in a seed cotton price of 34.56 cents per pound ($6.5 billion ÷ 18.7 billion pounds = $0.3456).

As identified in Figure 1, over the last decade seed cotton prices have averaged 34 cents per pound, ranging from a low of 26 cents per pound to a high of 43 cents per pound. For 2018 to 2028, the Congressional Budget Office is projecting a seed cotton marketing year average price of 34.2 cents – 2.5 cents below the reference price.

Reallocation of Generic Base

In order to participate in PLC, cotton farmers must have generic base acres. Generic bases acres were former upland cotton base acres but were made “generic” following the removal of cotton as a covered commodity in the 2014 farm bill. Generic base acres were eligible for ARC or PLC program payments if those acres were planted to a covered commodity.

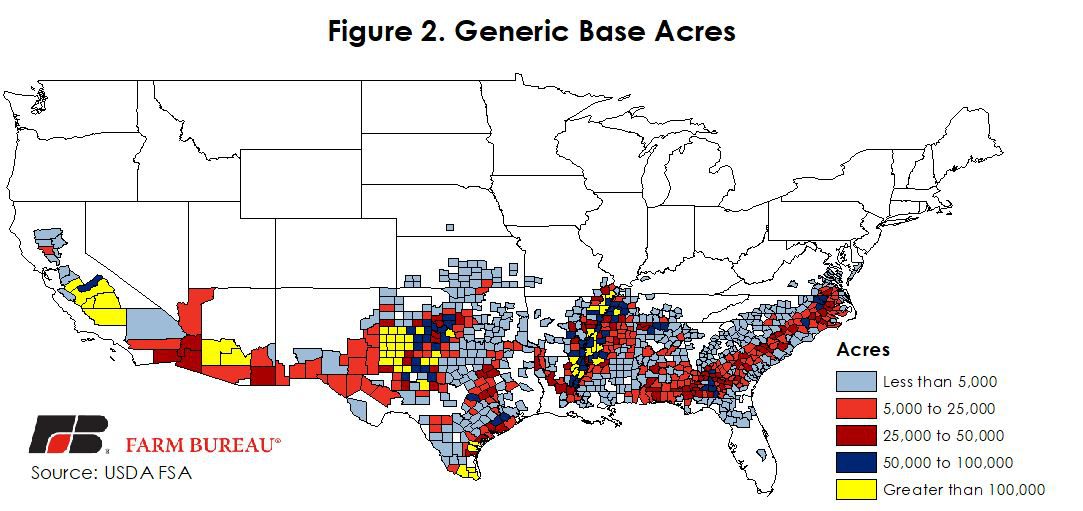

FSA data reveals 19 million generic base acres for the 2016 crop year. Of the 19 million generic base acres, 9.8 million were planted to program crops, 7 million were planted to non-covered commodities and 2.2 million were on non-enrolled farms. Figure 2 highlights generic base acres by county.

Cotton producers seeking to enroll in PLC will have a one-time opportunity to reallocate all the generic base acres on their farm. Generic base acres that were planted or were prevented from being planted to a covered commodity – including upland cotton – from 2009 to 2016 are eligible to be reallocated.

There are two options for reallocating generic base. The first option establishes base acres as the maximum of 80 percent of the generic acres or the average of planted and prevented planted upland cotton acres from 2009 to 2012 – but may not exceed total generic base acres. For this option, if 80 percent of the generic base is used, the remaining 20 percent of the generic base becomes unassigned base acres and is eligible for ARC or PLC. This is the default option for growers reallocating generic base.

The second option allocates generic acres in proportion to the 4-year average of planted and prevent acreage, including upland cotton, from crop years 2009 through 2012, to the total acreage considered planted for all covered commodities on the farm. This would allow growers who converted cotton ground into other commodities such as soybeans or peanuts to convert those base acres into non-cotton base.

Importantly, for farmers who have not planted a covered commodity or upland cotton from 2009 to 2016, their generic base acres will be converted to unassigned base acres and are ineligible for program payments.

Updating Payment Yields

When PLC payments are triggered, the total PLC payment to the farm is based on 85 percent of the farm’s base acres and 90 percent of the farm’s PLC payment yield. The 2014 farm bill allowed farmers to update PLC payment yields, and following those provisions, cotton producers will also now have a one-time opportunity to update payment yields for seed cotton.

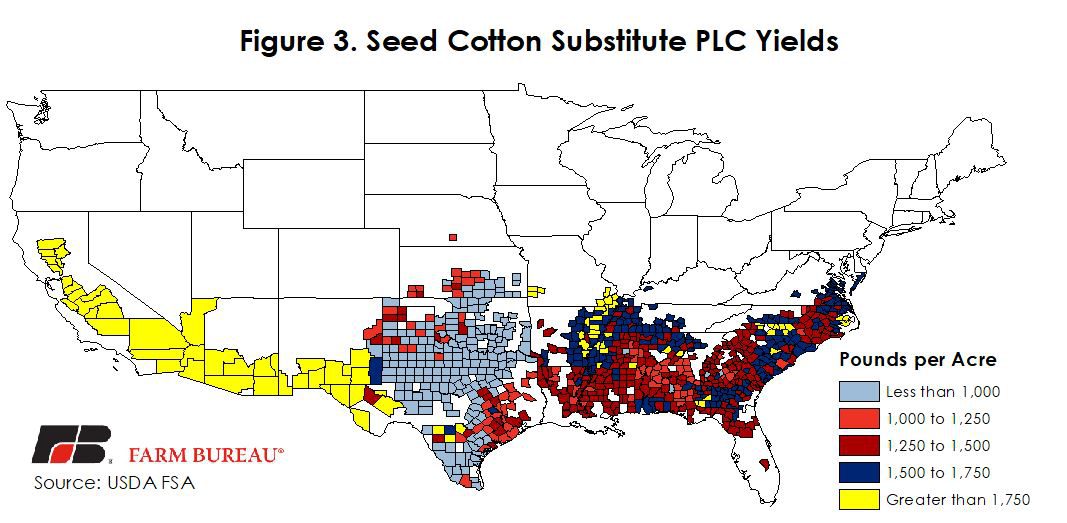

There are two options for updating PLC payment yields. Farmers can either use their pre-2014 farm bill payment yield for upland cotton multiplied by 2.4 or update the payment yield to 90 percent of the average upland cotton yields from 2008 through 2012. Figure 3 highlights potential seed cotton PLC payment yields established using pre-2014 farm bill payment yields multiplied by 2.4. It’s important to note that the House-passed farm bill provides an opportunity for farmers who experienced 20 or more consecutive weeks of D4 exceptional drought to update their payment yields under PLC.

Summary

Cotton and cottonseed prices have fallen sharply in recent years. For the 2017/18 marketing year, cotton prices were more than 20 percent below the highs seen in 2011. Similarly, cottonseed prices are nearly 50 percent below the 2011 highs. To aid cotton producers during this prolonged decline in prices, Congress reversed the 2014 farm bill removal of cotton as a covered commodity and designated seed cotton as a covered commodity. This provision of the Bipartisan Budget Act of 2018 made cotton farmers eligible for ARC or PLC.

For the 2018 crop year, FSA projects marketing year average seed cotton prices at 36.27 cents per pound, slightly below the reference price. If these prices are realized, cotton producers with seed cotton base could expect a program payment of 0.4 cents per pound. Total payments per base acre will depend on the farmer’s decision with respect to program yields.

Uncertainty remains. USDA’s most recent World Agricultural Supply and Demand Estimates projects the marketing year average cotton price at 75 cents per pound, 10 percent above 2017/18 levels. There are many months remaining in the cotton and cottonseed marketing years. The marketing year for both commodities will begin Aug. 1. For upland cotton, the marketing year ends in July 2019 and the marketing year for cottonseed ends in February 2019. Growers should continue to monitor supply, demand and price indicators to evaluate the program benefits of ARC or PLC prior to the enrollment deadline of Dec. 7.

Top Issues

VIEW ALL