U.S. Agricultural Land Values and Cropland Cash Rents Reach New Highs

photo credit: AFBF Photo, Mike Tomko

Daniel Munch

Economist

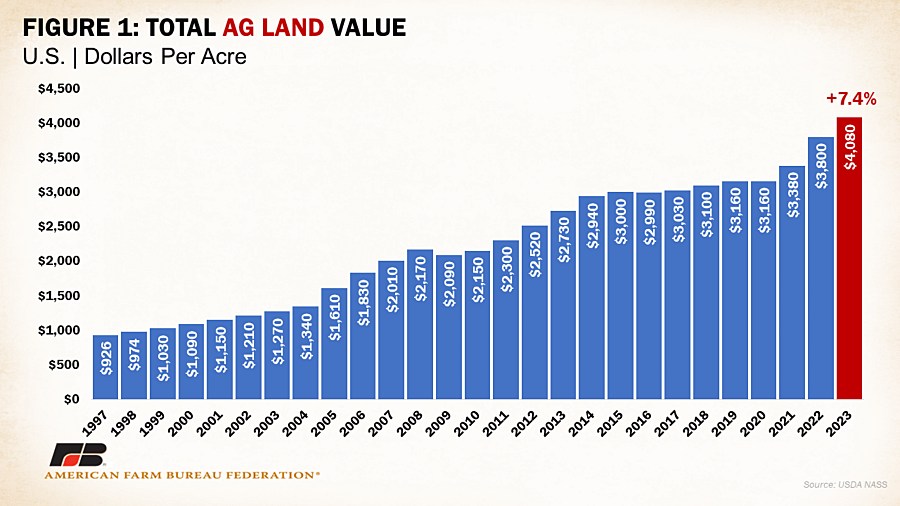

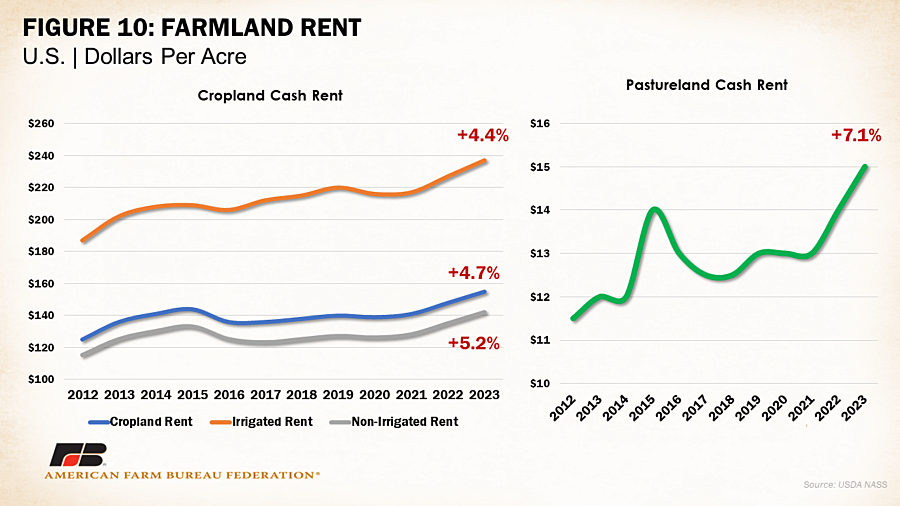

Agricultural land values increased by $280 an acre over 2022, according to USDA’s National Agricultural Statistics Service. The Land Values 2023 Summary report, released on August 4, shows a 7.4% increase following 2022’s record-breaking numeric increase of $420 per acre (12%) over 2021. Cash rent values for cropland were up 4.7% to a record $155 per acre and up 7.1% to $15 per acre for pastureland. This annual report provides one of many indicators of the overall health of the agricultural economy and illustrates yet another heightened production cost and barrier to profitability faced by farmers and ranchers.

Farm Real Estate Value

The U.S. average farm real estate value, a measurement that includes the value of all land and buildings on farms, clocked in at a record $4,080 per acre. This 7.4% increase over last year is less than the 12% bump between 2021 and 2022, which was the largest change since 2006, when values increased 14% over 2005. Excluding last year, 2023 farm real estate values had the largest percentage increase since 2014. Looking at the dollar value of the change, the $280 per acre increase over 2022 is the second-highest increase since the USDA began the survey in 1997.

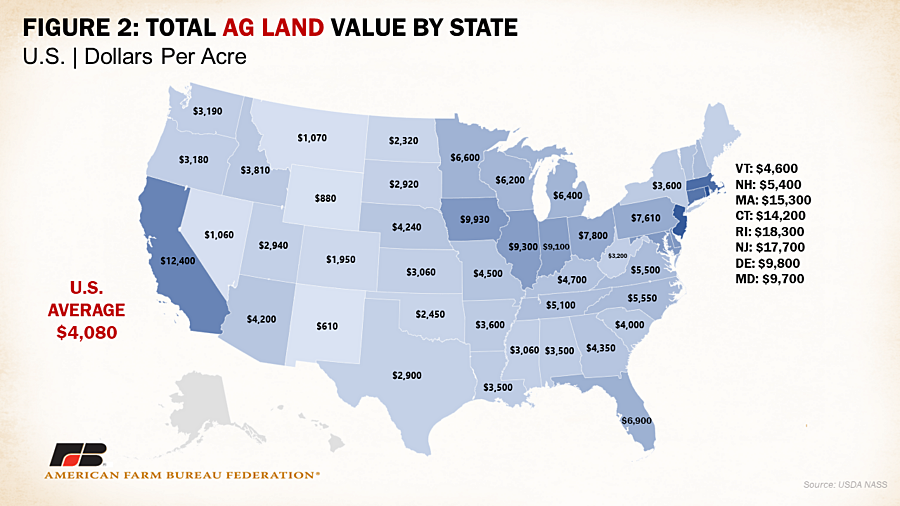

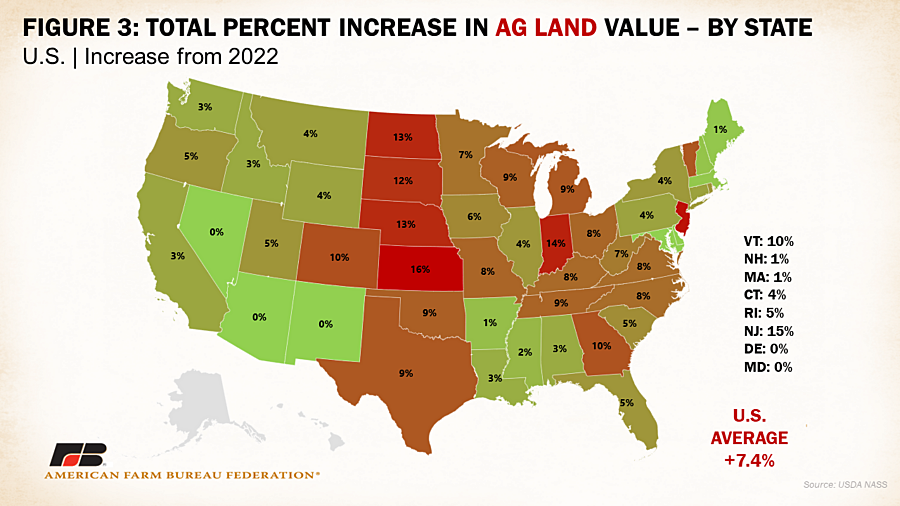

These levels vary significantly throughout the country, with the highest real estate values concentrated in areas with larger volumes of high-value crops (think wine grapes and tree nuts in California), as well as areas experiencing upward pressure due to proximity to urban areas with little remaining developable land, like the small states of the Northeast. Much of the Midwest had higher real estate values, followed by the South and Pacific Northwest, and finally the Plains and Mountain states. Part of this increase can be linked to high 2021/2022 commodity prices that have translated to a higher farming value for land in row crop-heavy heartland states like Iowa, Illinois, Nebraska, Kansas and Indiana. New government program incentives that provide financial compensation to landowners who voluntarily enroll and retire highly erodible and environmentally sensitive lands, such as those added in 2021 to the Conservation Reserve Program, also contributed to increased competition for active cropland, increasing land prices. Other factors contributing to rising land values are competing land-use interests, which includes urban and suburban sprawl, and increased investments into hard assets, like land, for a safer return on investment during an extended period of inflation. On a state-by-state basis, (excluding Northeast states with urban pressure), Kansas experienced the largest percent increase (+16%), followed by Indiana (+14%) and Nebraska (+13%). Nine states experienced double digit-percentage increases in 2023 farm real estate values, five of which are in the Midwest.

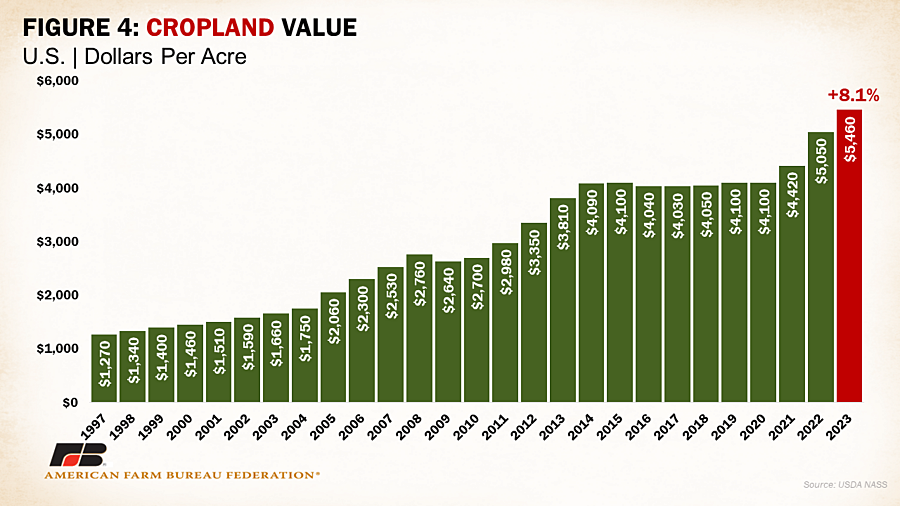

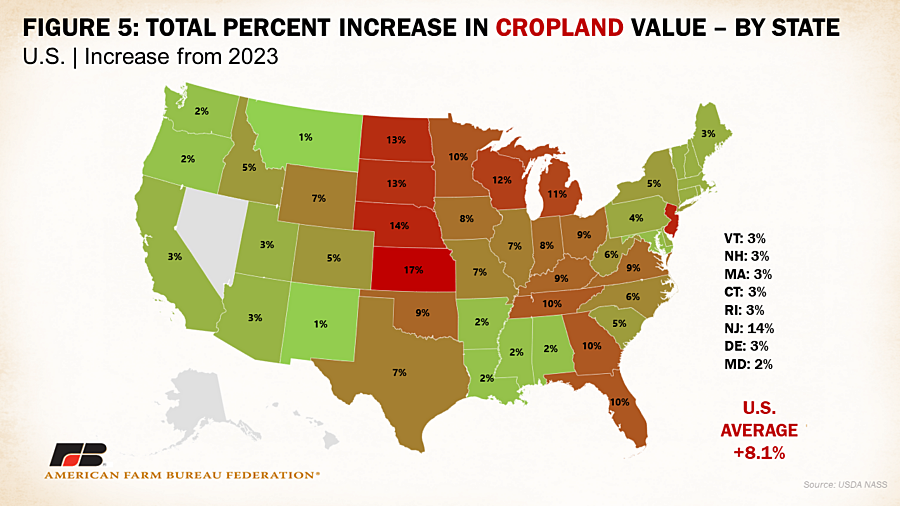

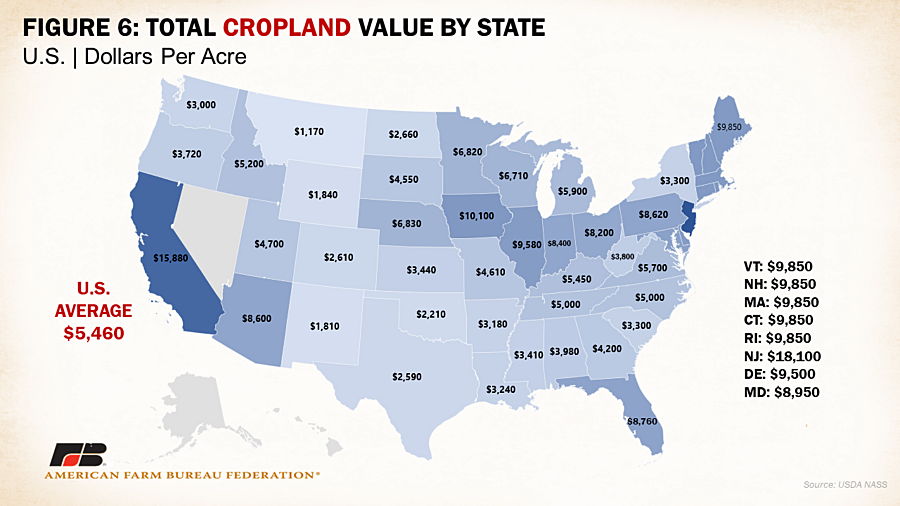

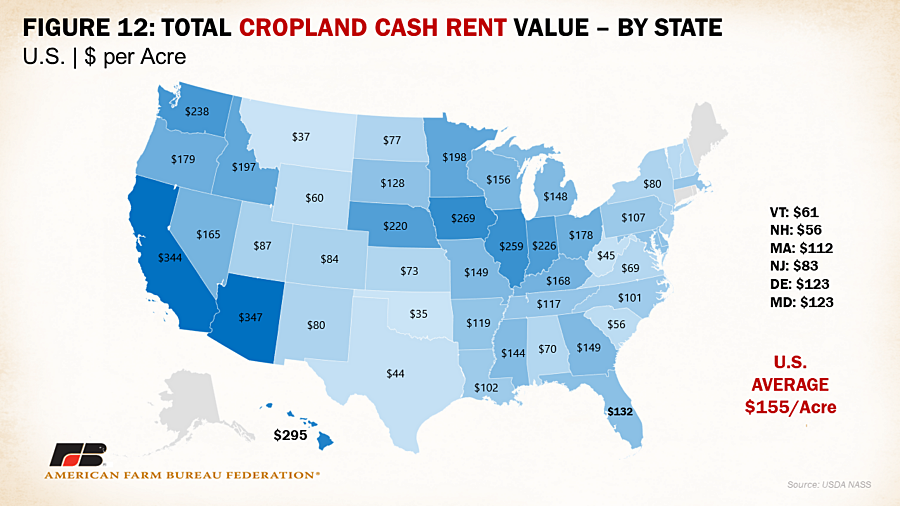

Like overall agricultural real estate values, average U.S. cropland values increased in 2023, rising to $5,460 per acre. This increase came in as an 8.1% jump over 2022, which is marginally higher than the 7.8% increase in cropland values in 2021 but is below double-digit percentage increases between 2005-2007, 2011-2013 and in 2022. In dollar values, this year-over-year increase was $410 per acre, the third highest behind 2022 and 2013. The distribution across the country follows a similar pattern as overall farmland value, with California and Northeastern states claiming the highest average cropland values. Following that top category is much of the Midwest, Florida and Arizona, the latter of which are both areas of high specialty crop value and residential development pressures. The top three states in terms of percentage growth are Kansas, Nebraska and the Dakotas, posting gains of 17%, 14% and 13%, respectively.

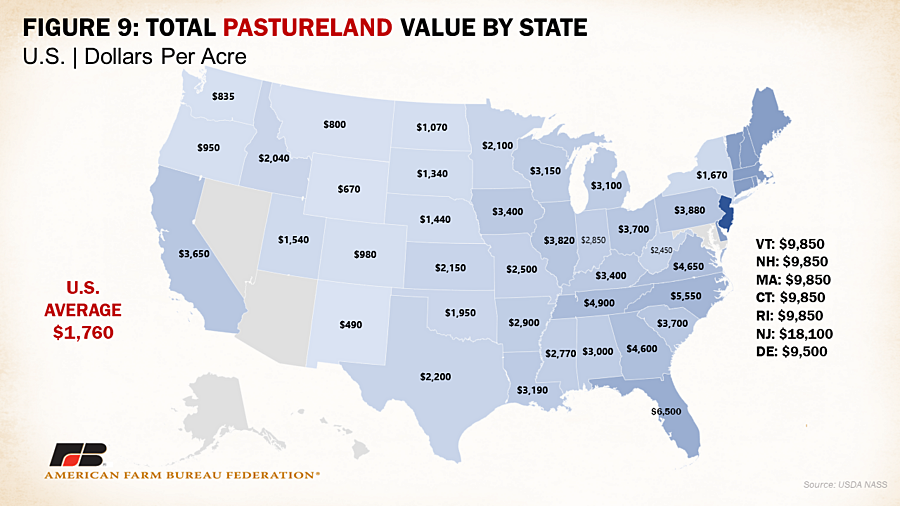

Pastureland Value

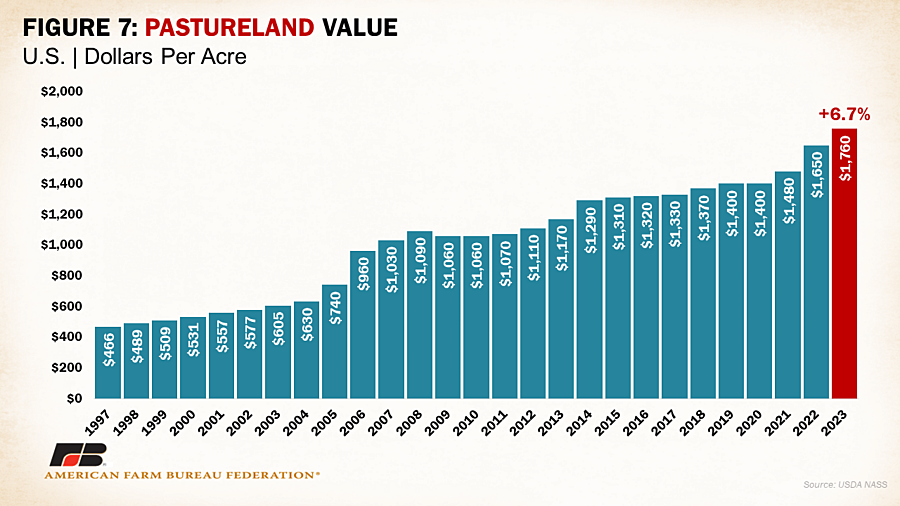

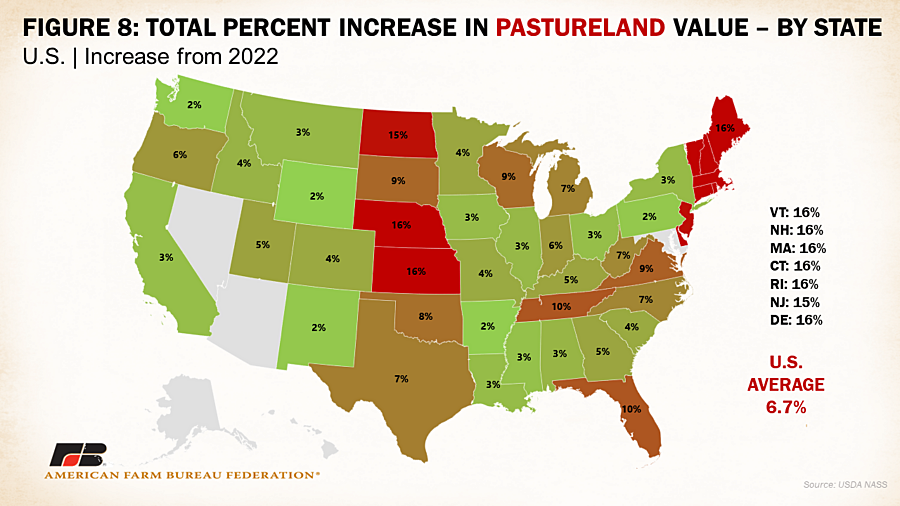

Similar to overall agricultural real estate values and cropland values, pastureland values posted strong gains from the previous year, coming in at $1,760 per acre on average for the U.S. This is an increase of 6.7% over 2022, a drop from 2022’s 11.5% increase from 2021 after seven years of little to no increases in value. However, the distribution of pastureland values across the country differs from cropland values and real estate values. Instead of the Midwest and California, some of the more valuable pastureland state averages are concentrated along the East Coast and in the mid-South, with the Midwest and the Plains toward the bottom of pastureland values. A very high percentage of grazeable land in the West is owned by the federal government, a portion of which is leased to ranchers using grazing permits. These dynamics limit the role of real estate competition for pastureland in many Western states. States with higher pastureland values tend to be those with higher competition for open land. As has been the case historically, the East Coast states are the most densely populated parts of the country and have correspondingly faced development pressures resulting in the slicing and dicing of properties at a higher magnitude than the rest of the country. This results in competition for a small number of plots that can provide adequate grazing features at a much higher cost.

Cash Rent Increases

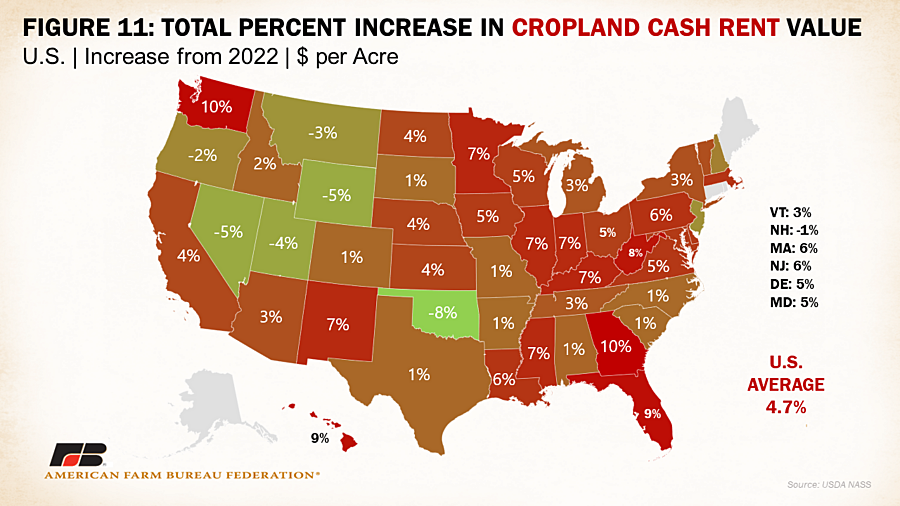

On August 4, NASS also released data on cash rents, with the increases in land values translating to increases in cash rent. Cash rent tends to be more of a lagging indicator, and likely will be reflected in future producer-landlord negotiations. Average U.S. cropland rent increased to $155 per acre this year, a 4.7% rise over 2022. Irrigated cropland rents increased 4.4% to $237 per acre, while non-irrigated cropland rents increased 5.2% to $142 per acre. Cash rents for pastureland increased 7.7% this year, reaching $15 per acre. As pressures on open land intensify across the nation for residential and energy development, leasing cropland becomes less profitable. These trends have been strengthened by the preference of office-based workers to work at home or away from a central urbanized office location, which provides people flexibility to work from rural communities and buy properties that compete with agricultural land use. Periods of heightened commodity prices also lead to higher leasing rates set by landowners.

Washington and Georgia led the country in highest percent increases in cropland cash rental rates in 2023 at of 10% each followed by Florida (9%). Decreases in cropland cash rental rates occurred in Oklahoma (-8%) and parts of the West like Wyoming (-5%) and Nevada (-5%). By value, the highest cropland rental rates were in California ($344/acre), Arizona ($347/acre) and Hawaii ($295/acre), all states with high-value orchard and specialty crops often linked to the existence of water rights that contribute to more valuable contracts. Washington and heartland states of Iowa, Illinois and Indiana made up the next highest cropland rental rate category, linked to higher value specialty crops for the former and a high density of high-value commodity crops in the latter. Correspondingly, irrigated cropland rent explains the bulk of cropland rental rates in California, Arizona, Washington and other Western states primarily reliant on surface water irrigation, while non-irrigated cropland rent explains that of Midwest states that rely heavily on dryland farming. The access to and cost of water play a large role in regional operating expenses as well as land value costs.

Margins for many producers who rely on rented land are jeopardized by even minimal changes in rental rates. This can threaten annual production output. More broadly, those who lack equity from land ownership have reduced access to operating lines of credit needed to fund annual equipment and input purchases; and rising land prices and rents often take away the benefits of high crop prices.

Conclusion

USDA’s land value report shows continued increases across the board in agricultural real estate values, cropland values and pastureland values. The average U.S. farm real estate value increased by $280 per acre, or 7.4% over 2022, while the cropland value and pastureland value increased by 8.1% and 6.7%, respectively. Cash rents have also jumped, ranging from 4.4% to 7.1% increases across cropland, irrigated and non-irrigated, and pastureland. In a continued period of heightened input costs across the board further exacerbated by inflationary pressures, high rent and land costs are yet another hurdle for farmers and ranchers working to produce more crops and raise more livestock. Fortunately for producers who own land, their equity has increased, but for those just starting out or reliant on the acres they rent to make ends meet, these increases can become an unbreachable barrier to entry.